Buyback guarantee: loan originator’s obligation to buy back a late loan on the 60th day of the delay latest. More information about the buyback guarantee can be found here.

Country: country in which the lending company operates.

Group guarantee: an additional guarantee signed with loan originators by the main PeerBerry partners Aventus Group and Gofingo Group. In case of insolvency of some company, other Aventus Group and Gofingo Group companies will cover all the liabilities on purpose to protect investors’ investments. More information can be found here.

Interest rate: annual interest (%).

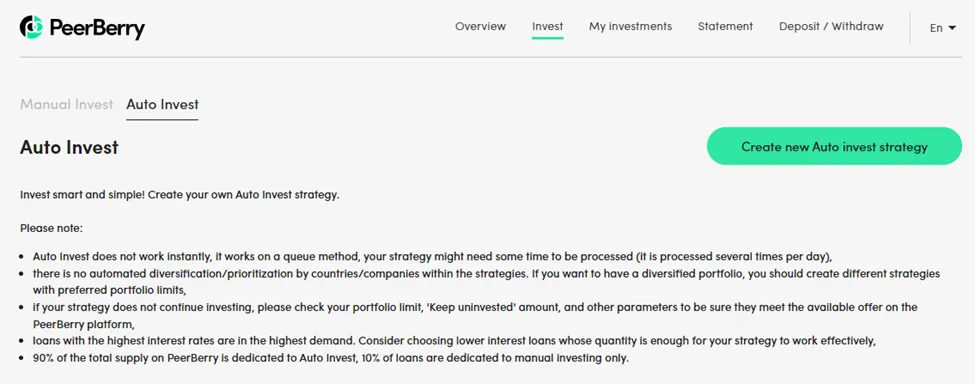

Invested during entire period: indicates the total amount of funds invested by an Auto Invest strategy since its creation.

Keep uninvested: the amount of money investor prefers to keep in the account not invested.

Loan originator: company that offers to invest in loans on the PeerBerry platform.

Loan type: defines the duration and purpose of the loan. PeerBerry offers to invest in short-term, long-term, leasing, real estate, and business loans. More information about the loan types offered may be found here.

Maximum investment in one loan: the amount of money, investor prefers to invest in one loan (value cannot be lower than 50 Eur).

Portfolio name: option to give a specific name to your manually created strategy.

Portfolio size (limit): all amount of funds investor prefers to invest using Auto Invest strategy.

Remaining term in days: duration of the loan which investor prefers to invest in.

Please note that Auto Invest cannot invest over your set limits.