For immediate cancellation, reach out to Client Support on the day of your investment.

Please note that PeerBerry does not have a secondary market. If the investment is not canceled within the same day, it will be finished and closed automatically, in the time frame of agreements.

Help center

We do not deduct taxes from investors, it is investors’ sole responsibility to pay all taxes arising from the income gained by using the PeerBerry platform.

Taxation of income for each investor is based on the legislation of the respective country where the investor is a tax resident. Reach out to local authorities for more information regarding taxation.

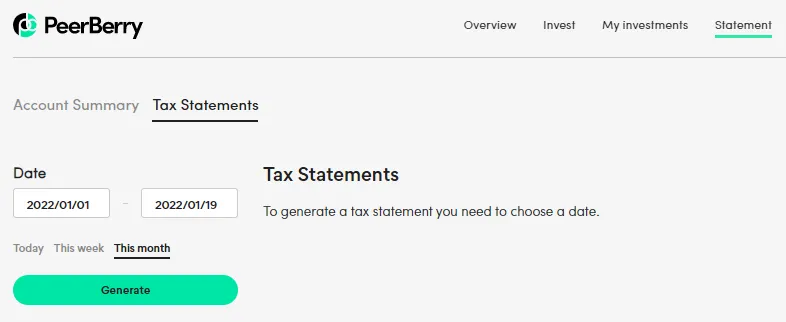

To generate a tax statement, go to your profile section ‘Statement’, set preferred dates, press ‘Generate’ and download:

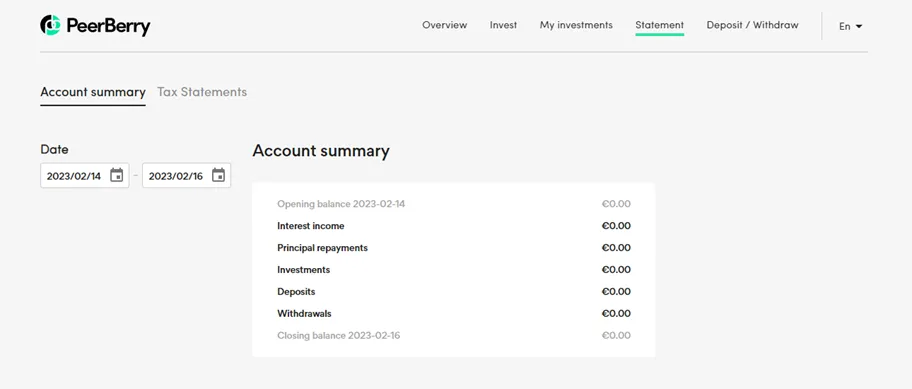

To check your ‘Account Summary’, login to your PeerBerry profile on our website, go to the ‘Statement’ -> ‘Account Summary’ section, select the timeline of your choice, and filter out the data based on that period:

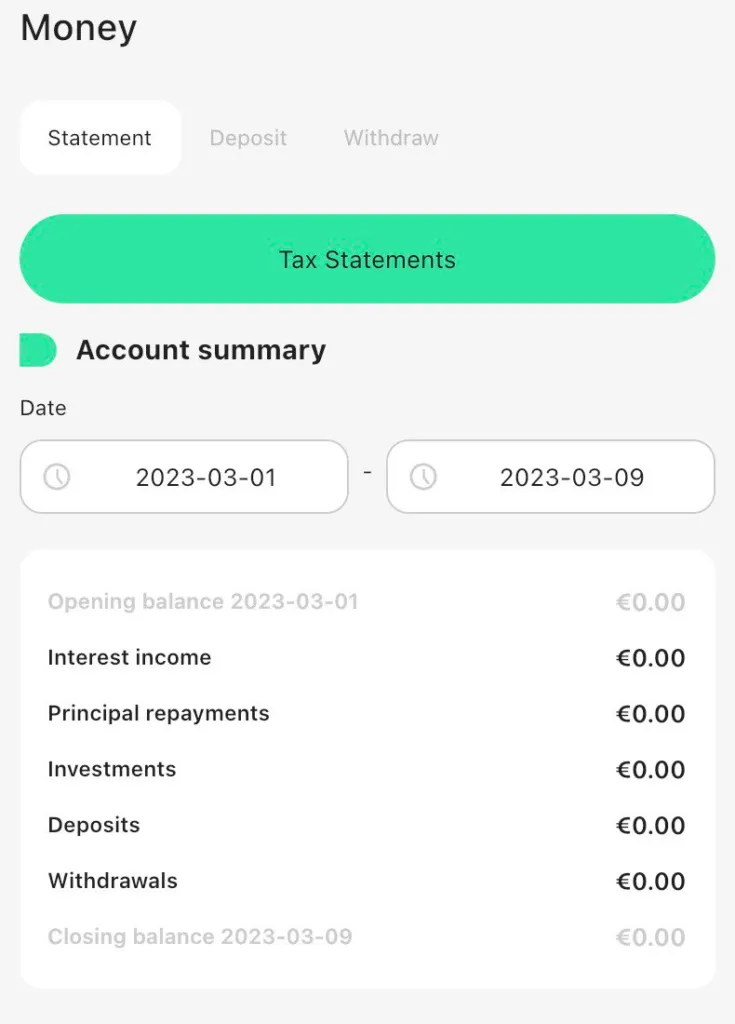

In the App, go to ‘Money’ -> ‘Account summary’ section:

Please note that you can also receive your ‘Account Summary’ data via e-mail. Go to your personal settings to modify the frequency of the ‘Account summary Overview’ e-mails.

Net annual return (NAR) measures the actual rate of return of all your investments since you started investing on PeerBerry (invested and not invested funds are taken into account). It also includes anything that affects your returns, such as delays and bonuses, and counted but not paid yet interest value.

At the beginning (if you have started investing recently) NAR is displayed higher or lower (depending on the invested amount), as counted but not paid yet interest value is included. Within a couple of months, NAR reaches the normal level/is displayed correctly.

NAR is calculated using the XIRR (extended internal rate of return) calculation methodology. More information about the XIRR and calculation formula can be found here.