01 April 2023

March 2023 | EUR 65,53 M of loans were funded

In March, PeerBerry investors funded EUR 65,53 million of loans, i.e., EUR 10,23 million or 18,5% more than the previous month. In March, our investors received EUR 877 001 in interest.

1071 new investors joined the platform last month.

The average annual ROI on PeerBerry in March was 11,11%.

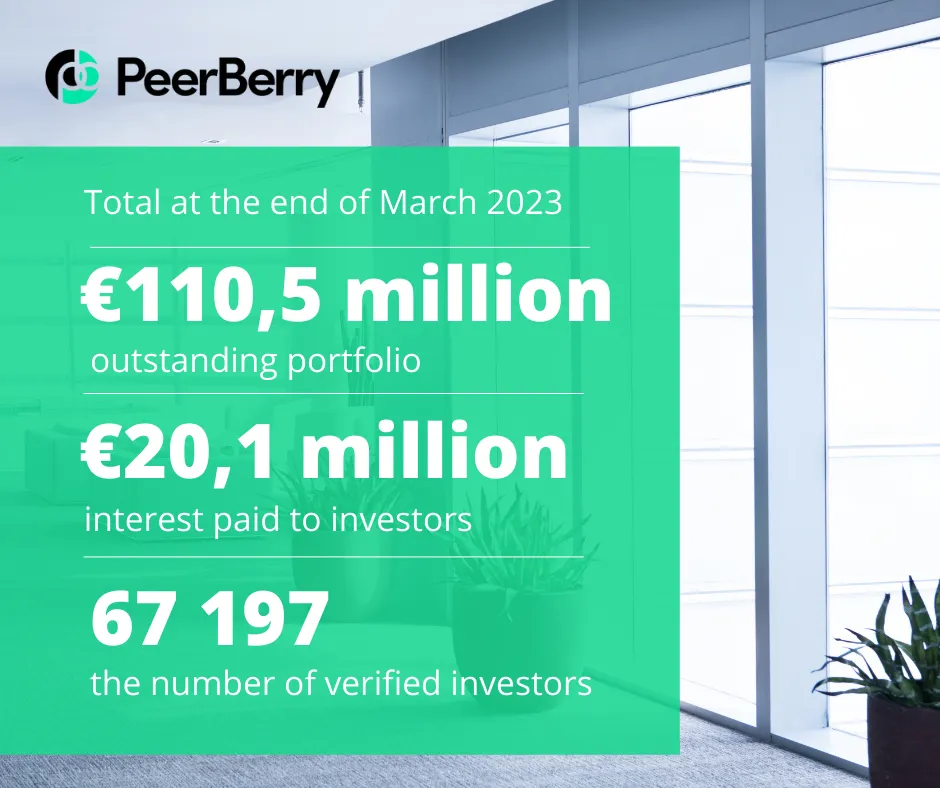

PeerBerry’s portfolio amounted to EUR 110,46 million at the end of March. Currently, PeerBerry joins over 67 000 investors.

Since PeerBerry‘s inception, PeerBerry investors have funded EUR 1.67 billion of loans.

PeerBerry business partners repaid over EUR 1,7 million in war-affected loans in March. Under the Group guarantee mechanism in 13 months of the war, PeerBerry business partners have already repaid EUR 34,8 million, or 69,3% of the total war-affected obligations towards PeerBerry investors.

PeerBerry will process the next repayment of war-affected loans in mid-April 2023.

Adjustments in the Auto Invest tool

To increase the effectiveness of Auto Invest, our team is constantly improving this tool. Certain adjustments were made in the Auto Invest tool at the end of March, one of which is the requirement to indicate an upper limit (at least EUR 50) we want to invest in one loan when adjusting or setting a new Auto Invest strategy.

Please note that the minimum investment amount on PeerBerry remains EUR 10. Such an amount can be invested manually; Auto Invest will also invest in loans from EUR 10. The new upper limit (EUR 50 minimum) means that our Auto Invest strategy will invest in any amount from EUR 10 to EUR 50. You can also set a higher amount than EUR 50; in such a case, the Auto Invest strategy will invest in any amount up to the amount specified in your strategy.

Why we implemented this change:

– we see that strategies with higher amounts for investors perform better. Strategies with higher amounts also require fewer operations for Auto Invest to invest the entire uninvested amount, which is less load on the system.

– please remember that there is no diversification through investments in small amounts when investing in loans issued by the same lender. When we invest in loans, we lend to the company that is issuing loans, so there is no difference if we invest EUR 10 in one loan, EUR 50 in one loan, or even higher amounts – the lender has an obligation to buyback loans we invested in no matter whether the end-borrower has repaid the loan or not. To mitigate risks through diversification, consider investing in loans issued by different lenders in different countries (but not in small amounts of loans issued by the same lender).

Please also note that the demand to invest in loans (especially short-term) is high on our platform. Combining manual investing with Auto investing helps to invest funds more effectively. Our platform lists new loans on business days in the first part of the day.

More opportunities to invest

You are welcome to consider additional opportunities to diversify your investment portfolio by investing in property-backed loans on a regulated crowdfunding platform Crowdpear represented by our team. Please find the details of the currently available project with up to 11.7% ROI on the Crowdpear website.