08 July 2020

2020 June | Investors Optimism vs Economic Reality

PeerBerry, along with its business partners, performed flawlessly like a Swiss watch during the crisis. There were no delays in the settlement with investors. The share of late loans on the platform even during crisis amounted just up to 15%.

Smooth performance of the platform was the main reason for the significant growth of investors activity in PeerBerry – in June, many new investors joined the platform, existing investors started significantly to increase their portfolios.

The main PeerBerry figures for June 2020:

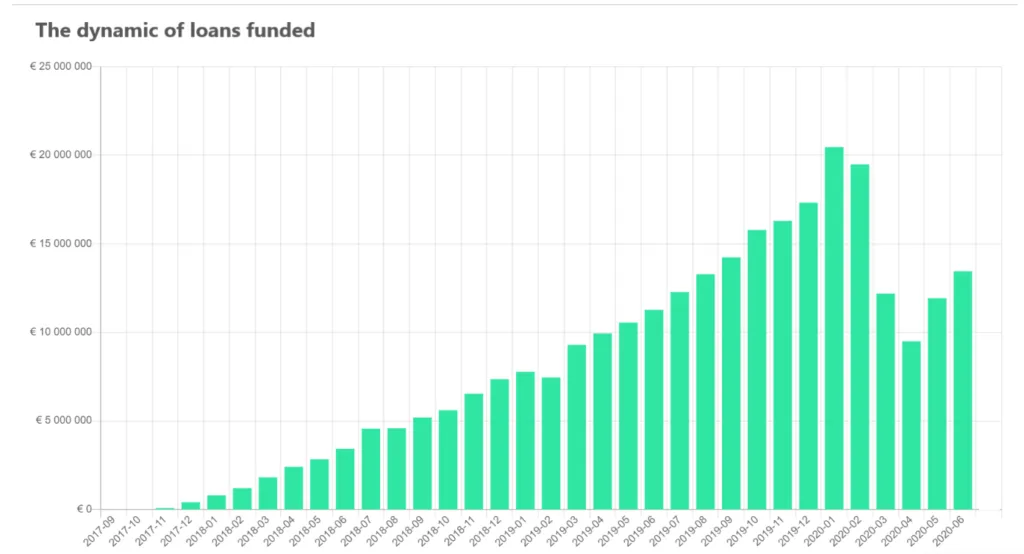

- total loan volume originated since inception – 278 911 370 Eur (+5% growth)

- loan volume originated in June – 13 445 322 Eur (+13% growth vs May)

- number of loans originated in June – 77 728 loans (+15% growth vs May)

- interest earned by investors since inception – 3 052 163 Eur (+6% growth)

- average annual investment return at the end of June – 10.01% (-3.65 pp vs end of May)

- average nominal interest rate of loans originated in June – 10.50 % (-2.64 pp vs May)

- number of investors at the end of June – 23 733 (+1180 new investors)

June brought new challenges for the platform. Investors’ activity grew in a very optimistic progression, while lending markets have been growing quite gradually. This resulted in limited amounts of new loans in the platform (compared to investors’ needs) and lower interest rates.

“In June, investors’ demand exceeded supply and we faced a challenge to meet the needs of all investors, i.e. new lending volumes were growing not enough to cover investors’ demand to invest. I will admit, I even had to negotiate with several large investors to postpone their willingness to invest on purpose to protect the interests of existing clients because currently, the competition among investors on the platform is very high” – explains Arūnas Lekavičius, CEO of PeerBerry.

At present, interest rates on PeerBerry are slightly lower than before the crisis, but this situation is a temporary consequence of economic circumstances. The sooner international markets stabilize, and lending volumes start to grow, the sooner we will be able to offer more investment opportunities on more attractive terms.

“I want to emphasize that risk management remains one of our highest priorities. Together with our partners, we will remain cautious and will apply all necessary means to protect our investors from the risk. The international markets are recovering very gradually, so our partners continue to apply tighter lending conditions. You can see that loans are issued very responsibly by the extremely small share of overdue loans on the platform. It is also very important to mention that in the history of PeerBerry, there have never been defaulted loans” – states A. Lekavičius.

In general, private individuals are starting to increase their consumption more and more actively, so it is very likely that lending volumes will slightly increase in July. Currently, together with our partners, we analyze the economic situation of the countries in which our lenders operate and make every effort to offer investors particularly safe investment opportunities” – says CEO of PeerBerry.