19 August 2022

Q&A | Important to know about repayments of war-affected loans

Dear investors,

Since the war in Ukraine started on February 24, every month we perform repayments of war-affected loans to our investors. In total, 42,21% of war-affected loans have been repaid already. We carry out regular and active communication, however, we still receive repeated questions on the same topic.

To help you better understand how the repayments of war-affected loans are being performed and where to find the information you need, we’ve collected the most relevant questions and answers in one place.

Why is the share of war-affected loans that I have received differ from the total share that PeerBerry communicates? For example, PeerBerry claims that 42.21% of war-affected loans have already been repaid, why am I only 25% or 30% repaid?

There are several reasons why the share of repaid war-affected loans varies for individual portfolios:

- When we communicate the entire amount of already repaid war-affected loans, we count all war-affected loan originators/all the amount repaid, while many investors have only invested in the loans of a few lenders. When the war started, 11 PeerBerry business partners fell into the category of companies affected by the war (3 in Russia and 8 in Ukraine). We see that most of our investors have invested in loans of 3-5 companies affected by the war. It is one of the reasons why the repaid share varies per individual investor.

- When the war started, (within the first week of the war) starting from Feb 24 our business partners repaid EUR 8,7 million from the reserves kept in the accounts in EU banks (money transfers from Russia and Ukraine were cut starting from Feb 24). At that time, we didn’t know what is the best way to act in this force majeure situation. Our system was not prepared for non-standard partial repayments of war-affected loans, which is why EUR 8,7 million was used to repay most overdue loans. If at that time your loans were not among those most overdue/late, this means you didn’t receive repayments at that time. It is another reason why the total repaid share of war-affected loans differs among individual portfolios.

- There are investors, who have investments in war-affected short-term loans only. Some have investments in both war-affected short-term and long-term loans. It is also the case why the repaid amount of war-affected loans can not be equal for everyone. Different composition of the portfolio brings a different share of the already repaid amount.

We want to remind you that the proportionality method for the repayments of war-affected loans started to be applied on April 6, after our system was prepared to implement these non-standard repayments. The essence of the proportionality method is that each investor monthly receives a part of the amount invested in each war-affected loan during each repayment.

What does the proportionality method for repayments of war-affected loans mean?

The proportionality method used for repayments of war-affected loans is an automated and quite complex process developed by our IT. The algorithm is coded in the system that checks data in the system, and automatically applies the proportionality method based on several criteria main of which are the size of remaining obligations of all war-affected lenders and the size of each investor’s investments in loans issued by each war-affected lender.

While the proportionality algorithm may sound complicated, the outcome is quite simple, for example, during the repayment we announce at least once per month, each investor receives the repayment of 3,5-4% (this % is just an example) of the remaining invested amount in war-affected loans.

Keep in mind that Ukrainian long term-loans (AutoMonay UA and Slon Credit UA) are being repaid under the initial schedules of these loans, and these repayments are not included in regular monthly repayments of war-affected loans. Repayments of Ukrainian long-term loans go on top.

If war-affected long-term loans are being repaid under their initial schedules, doesn’t this mean that these loans are treated better than short-term loans?

Absolutely not. The essence of the proportionality method is to repay each investor a part of the amount invested in each war-affected loan every month. This is exactly how war-affected Ukrainian long-term loans work – under the schedule, a part of the amount invested in the loan is repaid once a month. It is equal treatment compared to repayments of other war-affected loans.

We want to inform you that two long-term Ukrainian loans (Aventus Development/Aldega real estate and EuroGroshi business loans) are already repaid in full including the accrued interest. These loans can be found among finished investments in the My investments section of your account.

When do we receive the accrued interest for war-affected loans?

The accumulated interest will be paid together with the very last repayment of the invested principal amount.

Keep in mind that interest on war-affected short-term loans will be paid for the initial term of the loans plus 60 days of delay (to respect the term set in a buyback guarantee). Interest on war-affected long-term loans will be paid for 30+ days (depending on the loan schedule), as part of the interest on these loans was paid monthly before the start of the war.

Where can I see information / exact amounts of the repayments for my investments in war-affected loans?

Please note that you are receiving partial repayment on your war-affected loans monthly. Partial repayments mean that your loans are not repaid in full. So please do not look for your partial repayments among finished loans – you will not find partially repaid loans among finished loans until those loans are not repaid in full.

Please follow this instruction to see what amounts you have already received for your war-affected loans:

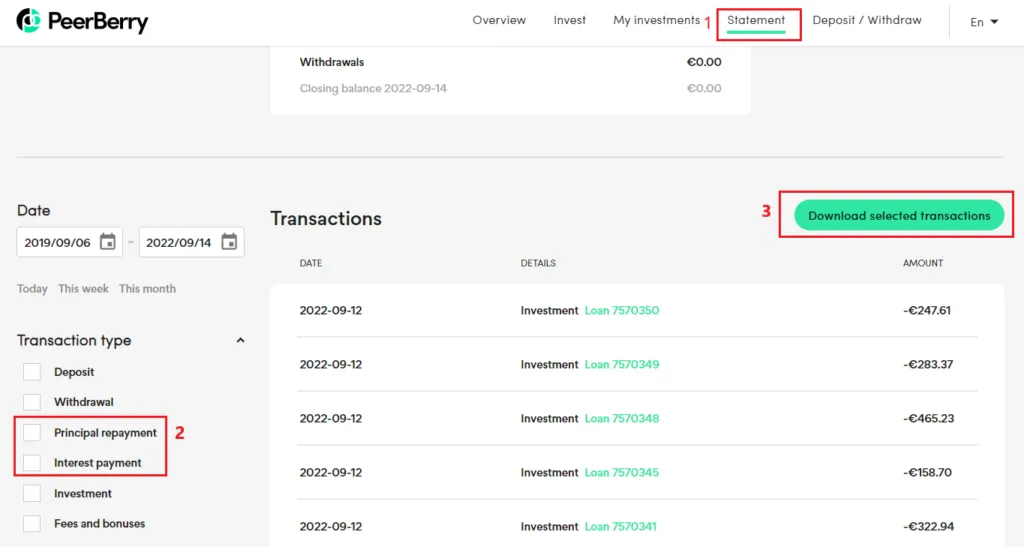

- go to your PeerBerry account,

- go to the ‘Statement’ -> ‘Transactions’ section,

- select filters ‘Principal repayment’ and ‘Interest payment’, and press the green button ‘Download selected transactions’,

- in the xls file, filter out the transactions in column ‘D’ – ‘Loan Status’ by status ‘On Hold’,

- summarize the ‘Amount’ column ‘F’ to see the amount repaid for the war-affected loans.

It is important to note that some of your investments in the war-affected Ukrainian and/or Russian loans may have already been closed and moved to the ‘Finished investments’ list in your ‘My investments’ section.

If you still have questions or need help finding necessary information in your account, please contact our Client Support.

Can I see a separate section of my war-affected loans in the PeerBerry app?

Unfortunately, not. To track information about the remaining amount of war-affected loans and the repayments on war-affected loans, we recommend using the desktop version, which is well developed for this purpose. The app is adapted and further developed for ordinary loans (not war-affected).

Recently, PeerBerry has announced being ahead of the initial plan to repay war-affected loans within two years. Do you have an updated target date when all loans are repaid?

As of today, in total 42,21% (or EUR 21,2 million) of war-affected loans are repaid already instead of 25% planned to repay within 6 months at the beginning of the war. So, we are 17,21% ahead of the initial plan, but we do not set new final dates to repay all war-affected loans as it may be irresponsible. Since the war-affected loans are still being repaid only by using the profits of the companies not affected by the war, the future repayments directly depend on the profitability of these companies, which may be affected by the general economic situation, etc.

If the same trend continues, the remaining part of war-affected loans decreases every month while the amount allocated for monthly repayments does not decrease, we will repay all war-affected loans faster than planned at the beginning of the war.

Where can I see the overall statistics of the repayments of war-affected loans?

You can see the progress of repayments of war-affected loans (the total repaid amount, the amount of remaining war-affected obligations, and repayments by separate lenders or groups) on our “Statistics” page on our website.