05 February 2021

January 2021 | PeerBerry starts the year with further growth

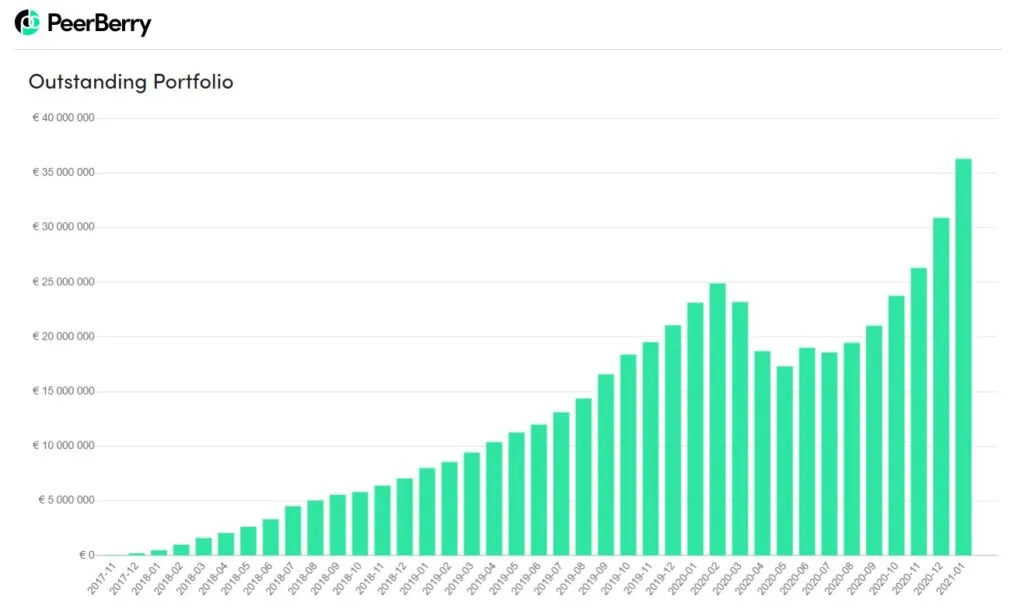

In January, PeerBerry recorded further growth and new heights in business volumes. The loan amount funded through the platform grew by 16,5% last month in comparison with December. According to the volumes of loans funded per every month, the PeerBerry firmly ranks as the second-largest platform in continental Europe.

The main PeerBerry figures for January 2021

- the total loan volume originated since inception – 420 077 983 EUR (+7.5% growth)

- the loan volume originated in January – 29 345 827 EUR (+16.5% vs December 2020)

- the number of loans originated in January – 168 500 135 559 (+24.3% vs December 2020)

- the interest earned by investors since inception – 4 528 256 EUR (+7.5% growth)

- the average annual ROI at the end of January – 12.23% (-0.12 pp vs December 2020)

- the average nominal interest rate of loans originated in January – 11,7 % (-0.3 pp vs December 2020)

- the number of investors at the end of January – 31 012 (+1441 new investors per month)

“The proven track record and PeerBerry stability lead to the significant increase of investor interest in the platform. The number of new investors is growing by thousands every month. The average deposit amount has also increased by 60% during the last few months. Currently, the average deposit on PeerBerry is 3 600 EUR.

The popularity of PeerBerry and the lower borrowing needs of our business partners currently lead to lower interest rates on the platform. We expect the activity in international markets to increase in March-April. In the few coming months, we plan to have larger volumes of loans on the platforms what will bring more opportunities for our investors to invest” – explains Arūnas Lekavičius, CEO of PeerBerry.

“In February, we will introduce the PeerBerry mobile app to our investors. In the final stage of the development, our team decided to add several features, that required extra time to develop the app. We will introduce the PeerBerry app later than we planned, but we believe our investors will appreciate that this product was worth the wait” – says A. Lekavičius.