23 October 2020

ROI is growing and other reasons why PeerBerry is the right place to invest

PeerBerry partners are preparing for the upcoming Christmas season and plan to issue about 30% more new loans in the coming months. It is good news for you, our investors, as higher lending volumes will lead to a higher need for our partners to borrow through PeerBerry, and for you, it will bring a higher investment return.

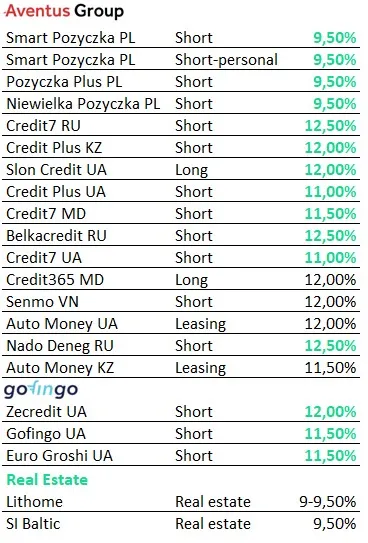

Updated higher interest rates take effect on the PeerBerry platform as of today. See the table below to see which PeerBerry partners offer higher interest rates. Increased interest rates are marked in green color. We kindly invite you to adjust your Auto Invest strategies accordingly.

Why now is the right time to invest

We understand that a pandemic situation does not help to cultivate optimism, but there are few rational reasons that have a solid basis for why investing now is the right time:

- Businesses and people have already adapted to the new reality. As the pandemic has been going on for almost a year, many businesses and people have been able to adapt to the changed circumstances – to work remotely, to change shopping habits, etc. Statistics in various countries show that e-commerce has grown significantly in the last 6 months. Our partners predict that as the holiday season approaches, people will borrow more and buy more online in the coming months. As our partners issue loans online, the whole process from getting a loan to buying online and repaying the loan should remain uninterrupted.

- Inflation. We are now living in a scenario of the second wave of pandemic crisis. Economists say the recovery will take time, and projected inflation is the price that people will eventually pay for a temporary solution with state subsidies. Investing now is a great way to save the value of your money and make a profit. You just need to choose the type of investing very responsibly and carefully.

- Higher ROI. Investing in P2P is one of the most attractive investment tools that generate relatively high ROI in comparison with other investment tools.

Security layers for PeerBerry investors – why PeerBerry is the right place to invest

PeerBerry has already proven during the most difficult time of the pandemic crisis this spring, that we are the partner you can trust.

We want to remind you how we ensure the security of your investments at PeerBerry:

- Our business partners accumulate a reserve of 10% of the total loan portfolio in cash, which ensures that our partners can settle with investors if this needs to be done more quickly and in a relatively short time, and larger volumes. This reserve helped us to show premium class performance during the panic time this spring – PeerBerry was probably the only platform that settled with all investors without any delay, immediately after the withdrawal request. Our investors have never seen any pending payments on PeerBerry. We do not impose any fees or other restrictions on the provision of services to investors.

- Our business partners borrow only up to 45% of their total loan portfolio via P2P. The rest of the loans are being issued by using our loan originators’ funds. This business discipline helps PeerBerry and our partners maintain a sustainable business model and avoid the too high level of debt. In other words, our partners borrow as much as they can repay in a relatively short time.

- Our partners apply sufficiently strict lending conditions. We have agreed with our business partners that the platform should be provided with the lowest risk loans. This helps us to maintain a relatively small share of overdue loans on PeerBerry. The share of overdue loans on PeerBerry usually is around 15-20%. And this is one of the best indicators in terms of overdue loans in the entire P2P market.

- The default rate of our partners is about 7% of the total loan portfolio. In the short-term loan business, this is one of the best indicators of defaulted loans. There have never been defaulted loans in PeerBerry’s history.

- All PeerBerry loans are secured with a buyback guarantee. Loans that subject to a buyback on the platform account for only about 1-2%. Overdue loans bear the same interest rates as current loans. In addition to the buyback guarantee, Aventus Group and Gofingo Group apply an additional Group guarantee.