16 October 2020

PeerBerry survey | Regulation is the key to the P2P future

Regulation is the key to the P2P future – stated most investors in the PeerBerry survey, conducted at the end of September. The data received from the survey only confirm the necessity to turn this statement into reality as soon as possible.

Investing in P2P loans is one of the most attractive ways to earn passive income. Because of the simplicity of the solution and good return on investment, this type of investment is a perfect fit for everyone – from students to seniors, from beginners to highly experienced investors. Compared to other investment instruments, investing in P2P loans brings fruitful profits.

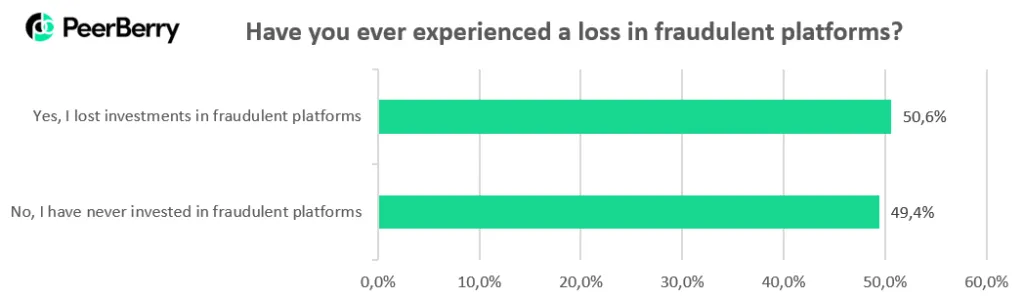

Unfortunately, the benefits of investing in P2P are undermined by intolerable things in the market. This year, at least ten fraudulent alternative investment platforms have disappeared from the P2P map, making huge losses for investors and causing reputational damage to the entire P2P sector.

The survey revealed that more than half of investors, who participated in the survey, had a loss from investing in fraudulent platforms.

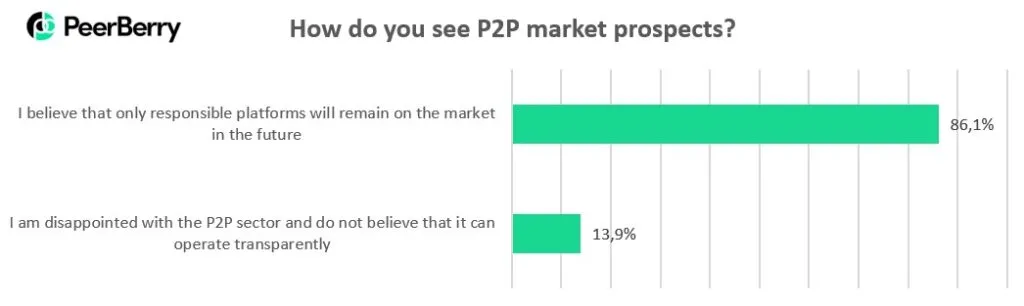

Although many investors were affected by fraudulent platforms, more than 86% of surveyed investors believe in a bright future for the P2P sector and believe that only responsible investment platforms will remain in the market after the market is regulated.

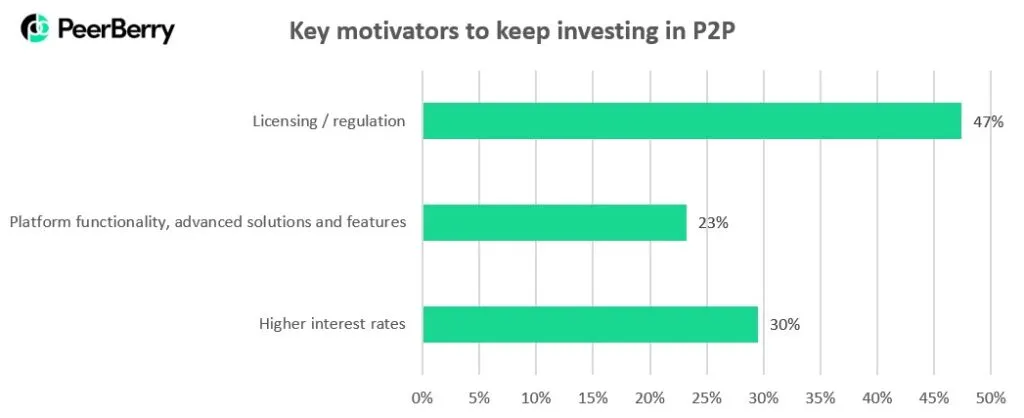

Licensing is the biggest motivator for most investors to keep investing in P2P loans. Licensing for investors is more important than a higher return on investment.

PeerBerry is on the way to becoming a regulated entity

At the end of April of this year, PeerBerry has submitted the necessary package of documents and the application for an Investment Brokerage Firm License to the Latvian regulator FCMC. Once licensed, PeerBerry will become one of the first regulated alternative investment platforms in Europe.

While the P2P market regulation process is underway in the Latvian market, there is active cooperation between PeerBerry and regulatory institution FCMC.

Regular online meetings are held every week to discuss various questions and details. The platform regularly provides additional information upon regulator requests. Since the beginning of cooperation with the Latvian regulator, PeerBerry is submitting a monthly report to the FCMC while not having the license. In other words, PeerBerry is already operating based on the requirements of the regulator.

P2P market regulation will bring more clarity for the whole industry, more transparency, and more guarantees to investors.

While regulation is in the process, we recommend you to read the P2P Empire research about upcoming P2P market regulation and IBF license.

More about recent PeerBerry survey

PeerBerry survey involved 2,975 investors from 40 countries. The survey was conducted on September 24-28, 2020.

PeerBerry’s survey part 1 – Most investors were not affected by the pandemic (open here).

PeerBerry’s survey part 2 – The PeerBerry brand is perceived by most investors as a reliable and stable. PeerBerry is rated higher than the P2P market (open here).