01 June 2020

PeerBerry partner Slon Credit has ambitious plans for the future

Slon Credit is the Aventus Group company in Ukraine, which provides consumer long-term loans. Slon Credit is listed in the register of Financial Companies in Ukraine and is a member of the Ukrainian Association of Financial Companies.

Established in October 2018, Slon Credit has ambitious plans for the future. The company seeks to be locally known as an easy to use, transparent and reliable consumer installment loan provider. Currently at Slon Credit work 40 employees.

“Slon Credit is the first company in the Ukrainian market to issue long-term loans on-line and off-line through brokers and intermediary banks” – what makes the company special compared to other lenders in the market explains Nikolay Rokhmaniiko, CEO of Slon Credit, Ukraine.

The main differences between micro-credit companies and Slon Credit are the term and average amount of the loan.

“Our product is very attractive to investors, as they invest in quality clients’ loans for relatively long term. The term of our loans is up to 36 months and the amount – up to 3,400 Eur with a monthly payment. For comparison, the term of microloans is up to 30 days and the amount is up to 340 Eur with a single repayment” – what are the main differences in comparison with other market players explains N. Rokhmaniiko.

“As for the needs of customers, they are various. Most often clients take loans for repairing a home or buying different kinds of equipment. The company covers almost all possible segments of clients’ needs” – says N. Rokhmaniiko.

Slon Credit issues loans for the purchase of various equipment in the top trading networks in Ukraine. The company also cooperates with the largest brokers in Ukraine, such as Smart Finance, Credit Finance, Target Finance. The issuance of loans is implemented through local banks. Among the largest partners are Alfa Bank, Taskombank, PUMB Bank, Credit Market, Accord Bank, Forward Bank. The company uses telemarketing services for promoting issuing loans as well.

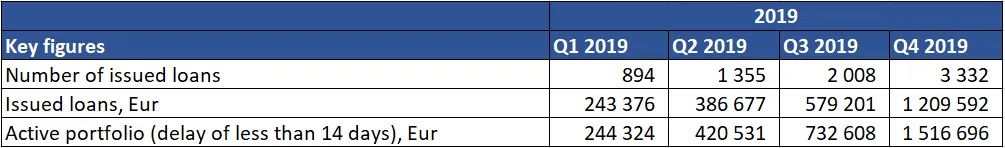

Company results for 2019:

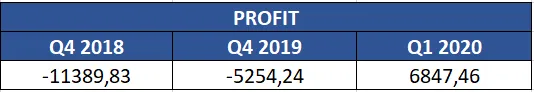

“Since Slon Credit provides long-term loans, there were relatively high costs at the beginning of business development. Within the first year of our activity, we made necessary investments to the purchase of software, staffing, and issuance of loans. As was foreseen in our business plan, investments in starting our business had an impact on the company’s profit in the first year of operation. In 2019, Slon Credit issued 7,589 loans worth 2,418,846 Eur. Our initial plan for 2020 was to grow by 5 times in all indicators. But since March of this year, the picture has changed. However, even taking into account the unfavorable situation in the world, we managed to reach a profit of 6,847 Eur at the end of Q1 2020.

As all the business infrastructure of Slon Credit has already been developed, no additional investments are required for this year. Slon Credit plans profitable activity in 2020 and an increase in business volumes despite the prevailing challenges in the market.

We invite you to review an audited Financial statement 2019 of Slon Credit here or in the page Loan originators in our website.

Visit Slon Credit on https://sloncredit.com.ua/.