14 October 2022

EUR 5124 is the average portfolio on PeerBerry

The average portfolio size of an active PeerBerry investor is EUR 5124.

PeerBerry currently has 60 500+ verified investors. The total amount of investments on the PeerBerry platform – the PeerBerry portfolio – exceeds EUR 96 million.

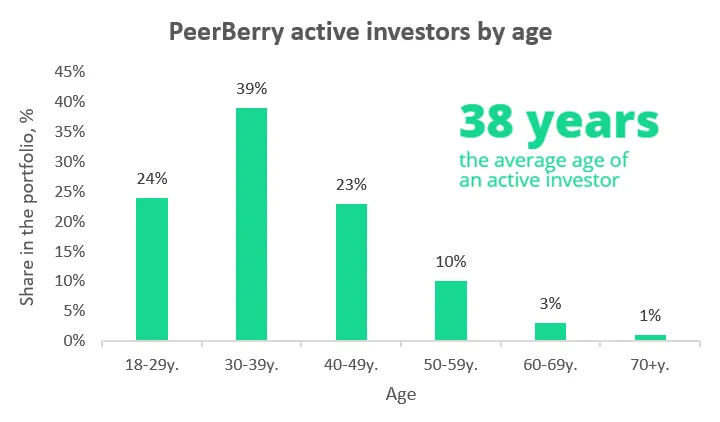

The average age of an active PeerBerry investor is 38 years old.

The definition of an active PeerBerry investor includes only those investors who have active investment portfolios on the platform.

Most active PeerBerry investors are between the ages of 30 and 39 years. 76% of active PeerBerry investors are men, and 24% are women.

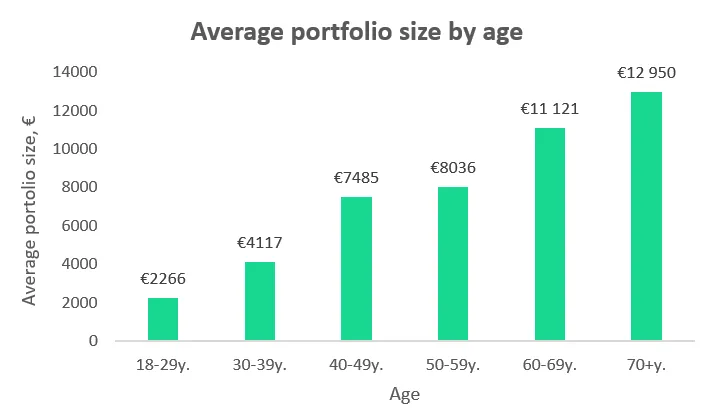

Our portfolio analysis shows that older investors’ average portfolio size is larger than younger investors’ portfolios.

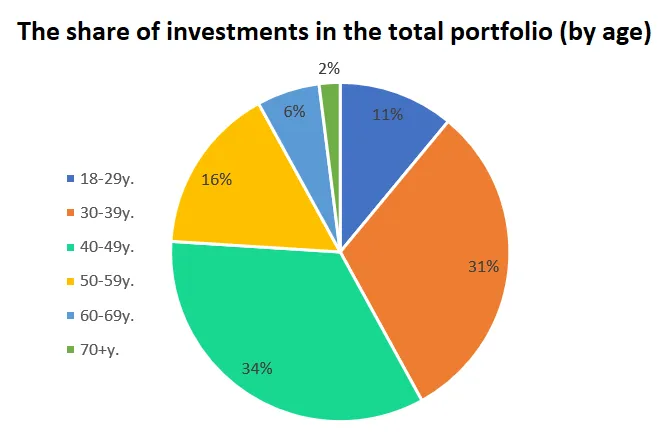

Investments of investors between the ages of 40 and 49 make up the largest share (34%) in total PeerBerry’s portfolio. The second largest share in our portfolio comprises portfolios of investors aged 30 to 39 (31% share); 16% of investments in PeerBerry’s portfolio are made by investors aged 50 to 59.

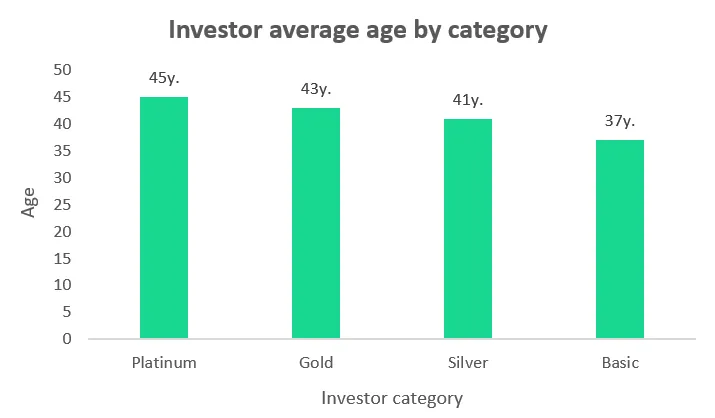

PeerBerry has several categories of clients based on the size of their investment portfolios:

– basic category (portfolios up to EUR 10 000),

– loyalty category Silver (portfolios from EUR 10 000 to EUR 25 000),

– loyalty category Gold (portfolios from EUR 25 000 to EUR 40 000),

– loyalty category Platinum (portfolios over EUR 40 000).

The average age of PeerBerry investors without the loyalty category is 37 years; the average age of the Silver category investors is 41 years; the Gold – is 43 years, and the Platinum investors are 45 years old on average.

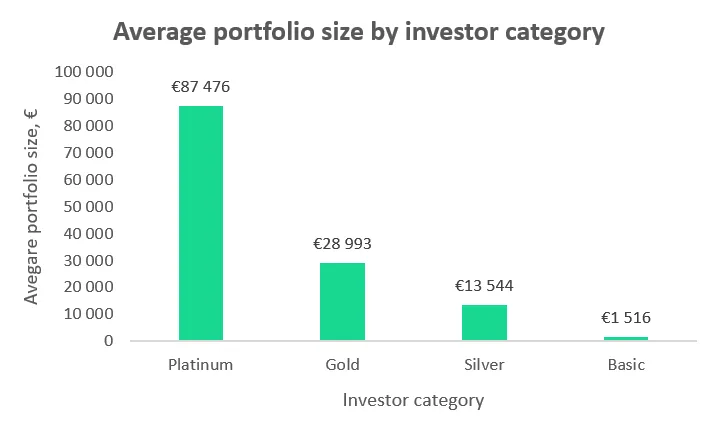

The average portfolio size by the investor category:

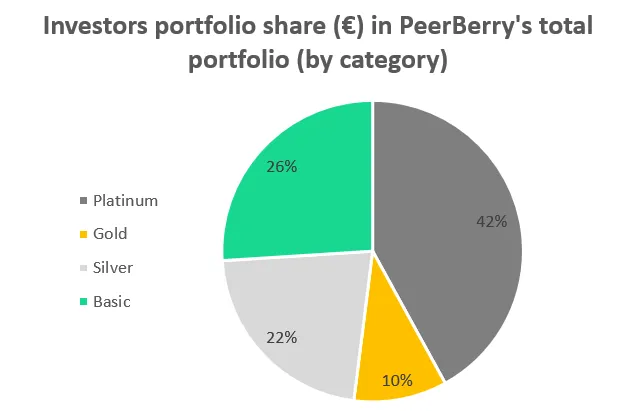

The largest share in PeerBerry’s total portfolio makes up portfolios of Platinum investors – 42% of the entire PeerBerry portfolio.

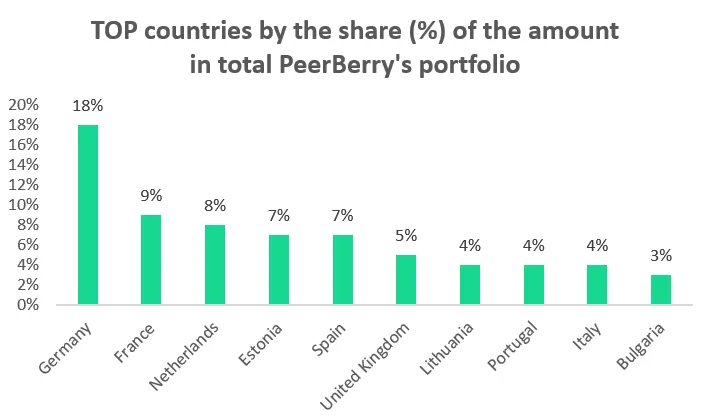

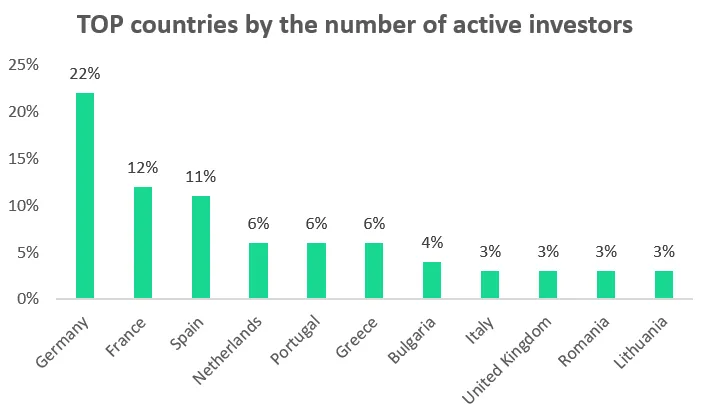

Germany (22% of active investors), France (12%), Spain (11%), the Netherlands (6%), Portugal (6%), and Greece (6%) are the countries from which PeerBerry has the highest number of active investors.

In the TOP 10/11 countries also are Bulgaria (4%), Italy (3%), the United Kingdom (3%), Romania (3%), and Lithuania (3%).

Investors from other countries make up 21% of the portfolio of PeerBerry’s active investors.

In total, PeerBerry has active investors from 102 countries.

The top 10 countries (Germany, France, the Netherlands, Estonia, Spain, United Kingdom, Lithuania, Portugal, Italy, and Bulgaria) make up more than 50% of total PeerBerry’s portfolio amount.