17 January 2020

Aventus Group business review of 2019

The year 2019 was very dynamic and vibrant year for Aventus Group business. In comparison with 2018, the Group grew up by almost three times last year.

The main statistics of 2019

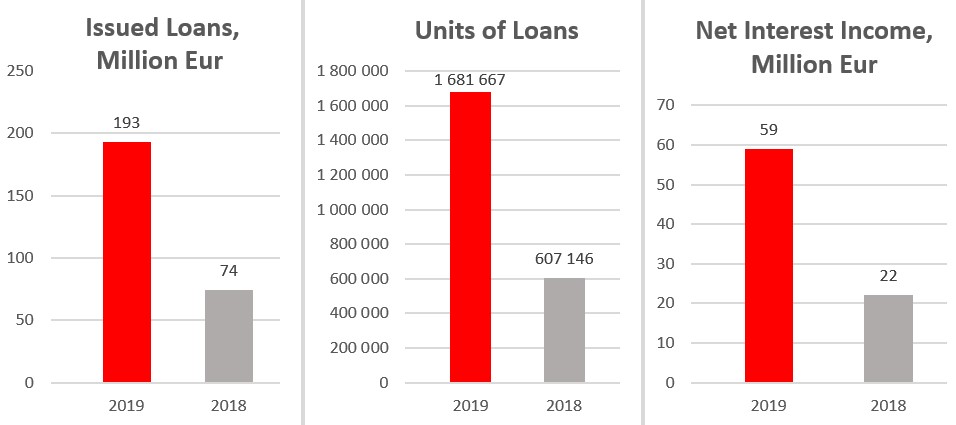

In 2019, Aventus Group companies issued 193 million Eur loans – 2,6 times more than in 2018.

More than one million – 1 681 667 units of credits (including credits with prolongations) in total were issued during the year 2019. It is 2,8 times more in comparison with credit volumes in 2018.

Net interest income of Aventus Group companies amounted 59 million Eur over the year 2019. It is 2,7 times more in comparison with the year 2018.

Total loan portfolio of the Group at the end of 2019 amounted 58,82 million Eur. At the end of 2018 total loan portfolio amounted 30,71 million Eur.

During last year the number of clients has more than doubled – at the end of 2019 the Group had 3,31 million registered clients. At the end of 2018 the number of clients was 1,39 million.

Last year the team of Aventus Group has grown from 250 to almost 700 employees.

During the year 2019 Aventus Group donated over 150 000 Eur to various charity programs dedicated to help children, who have been diagnosed with cancer and other serious diseases.

Business expansion in 2019

Last year Aventus Group was successfully strengthening its’ positions in those markets, where the Group operates. The Group has purposefully developed the network of business units, with the focus to make its’ services available to the maximum number of potential clients.

The year 2019 was also very productive for the Group in terms of entering new markets and offering new products. New car leasing branches in Belarus, Ukraine, Russia, Kyrgyzstan and Kazakhstan were opened. Online credit companies were launched in Sri Lanka and Vietnam.

Business expansion remains in Aventus Group targets for 2020 – to expand business network in existing business markets and to establish new companies in new markets.

About Aventus Group

Aventus Group is the main PeerBerry partner. The majority of loan originators at PeerBerry platform are companies which work under Aventus Group name.

The loan portfolio of Aventus Group companies at PeerBerry accounts for 80% of total loans.

By combining client-centric approach, risk management and innovations Aventus Group makes borrowing faster, easier and hustle-free in countries where traditional financing tools are either expensive or hard to come by. Profitably operating for more than 10 years, the Group is seeking to expand business in European and Asian markets by increasing market share, introducing new products and expanding geographically. Aventus Group operates in 12 countries: Lithuania, Poland, Ukraine, Belarus, Czech Republic, Russia, Kazakhstan, Moldova, Kyrgyzstan, Vietnam, Philippines and Sri Lanka.