04 May 2022

April 2022 | Growth and stability on PeerBerry

While crisis management was the main priority in March, April brought clarity and stability to both PeerBerry’s business partners’ activities and PeerBerry’s daily operations.

Proper management of the crisis led PeerBerry to growth and positive balance in April. Last month, PeerBerry investors funded a 37,6% higher amount on new loans than in March. A higher number of new investors joined PeerBerry in April, compared to March.

Key figures at the end of April 2022 (vs March 2022)

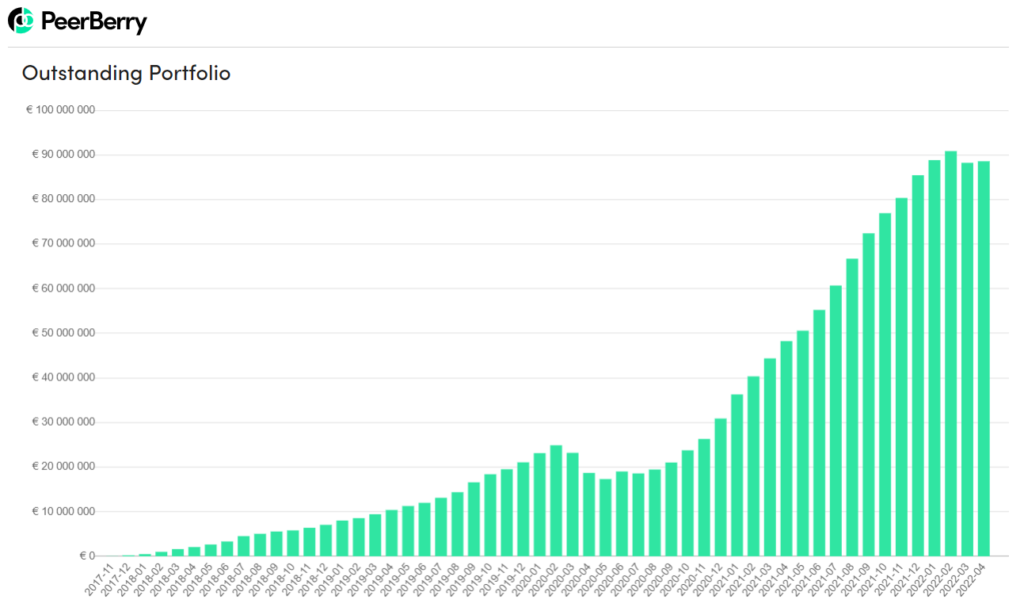

- PeerBerry’s total portfolio at the end of April: EUR 88 560 332 (+0,4% ↑)

- total loans funded (cumulative since inception): EUR 1 146 179 619 (+3% ↑)

- the loan volume funded in April: EUR 33 248 010 (+37,6% ↑)

- the interest earned by investors since inception: EUR 12 946 826 (+3,6% ↑)

- the interest paid to investors in April: EUR 450 386

- the average annual ROI in April: 12.77% (without loyalty interest)

- the number of investors at the end of April: 54 541 (+1053 ↑)

PeerBerry investors are actively making new deposits and reinvesting their current funds on the platform, that is why the total PeerBerry portfolio after large regular repayments on war-affected loans remains stable.

Information on repayments of war-affected loans

In April, PeerBerry together with its partners held two meetings with investors – the Independent Supervisory Board members to discuss the overall business development and the progress of repayments of war-affected loans.

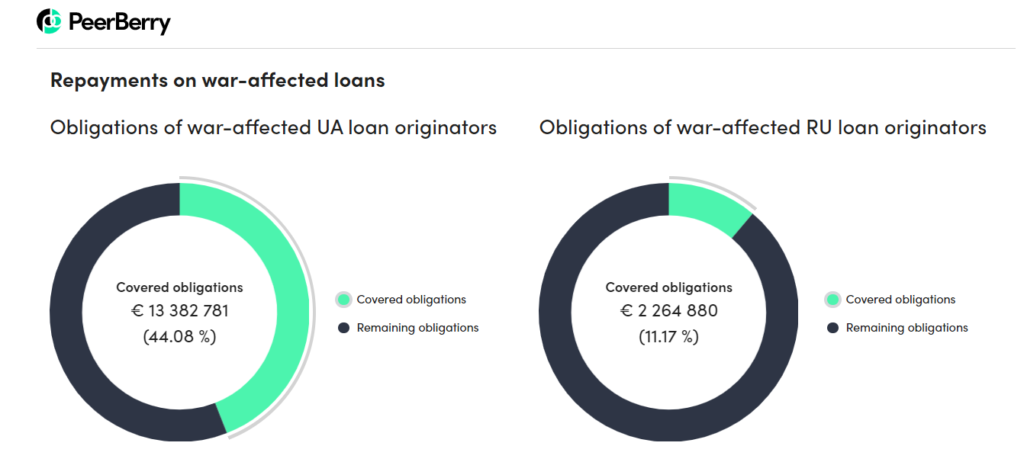

The total amount of EUR 3,64 million of war-affected loans was repaid to PeerBerry investors in April. EUR 12,34 million (or ¼ of the total war-affected obligations) of war-affected loans was repaid to PeerBerry investors since the war in Ukraine started.

To see the progress of repayments of war-affected loans (to see the total repaid amount, and the amount of remaining war-affected obligations), we added a chart on our “Statistics” page on our website:

If you have questions regarding your investments in war-affected loans or if you need our assistance to help you to understand what amount of war-affected loans you have received after partial repayments, we kindly invite you to contact our Client Support.

We want to remind you, that partial repayments of war-affected loans are being implemented every month until all war-affected loans will be repaid.

Our communication in April 2022:

April 28: PeerBerry repays an additional EUR 0,7 million on war-affected loans

April 27: PeerBerry partner in Moldova earned EUR 312 509 in net audited profit in 2021

April 26: PeerBerry partners’ business figures in April | Summary of the Independent Supervisory Board meeting

April 22: PeerBerry partners covered 23% of war-affected obligations already

April 19: PeerBerry restores regular monthly payments on Ukrainian long-term loans

April 15: Lithome has repaid a loan of EUR 1 million and paid EUR 91 647 interest to PeerBerry investors

April 8: Few options to support Ukraine

April 6: EUR 10 million has been dedicated to repaying war-affected loans

April 1: March 2022 | PeerBerry passed one more business resilience exam