10 June 2020

2020 May – the month of recovery and growth

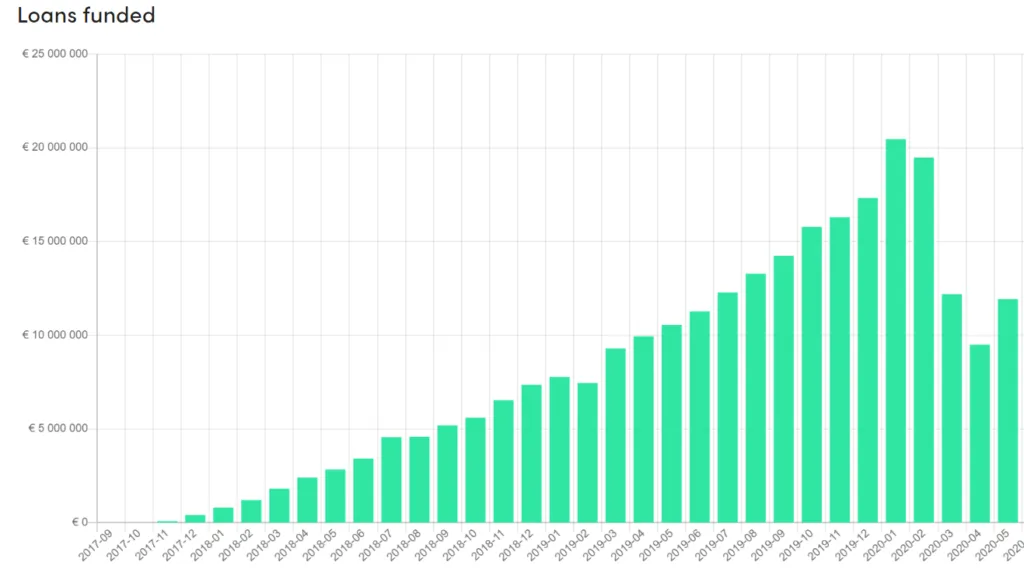

If PeerBerry recorded clear signs of market stabilization in April, we could confidently say the market fully recovered in May. In May PeerBerry reached a positive balance: the volume of new investments returned to the level of March; in May, the platform had fewer withdrawals than in March; the growth of the number of new investors per month exceeded the pre-crisis level.

The main PeerBerry figures for May 2020:

- total loan volume originated since inception – 265 466 048 Eur

- loan volume originated in May – 11 921 427 Eur

- number of loans originated in May – 67 324 loans

- interest earned by investors since inception – 2 878 324 Eur

- interest paid to investors in May – 249 518 Eur

- average annual investment return at the end of May – 13.66%

- average nominal interest rate of loans originated in May – 13.14 %

- number of investors at the end of May – 22 553

Back to normal

“The numbers speak for themselves. I am delighted that together with our business partners, we have managed the most difficult phase of the crisis smoothly and have justified the expectations of all our investors. All our investors will agree with me – we made payments on time immediately after the withdrawal request. I am also very pleased that our business partners were prepared for the most difficult crisis scenario, so it was not difficult to overcome large-scale challenges,” – says Arūnas Lekavičius, CEO of PeerBerry.

The fact that the crisis has been successfully managed is also reflected in the decrease of loan interest rates on PeerBerry.

“Currently, investors’ activity on PeerBerry is growing faster than the need of our loan originators to borrow through P2P. At present, our loan originators still lend on tighter terms, resulting in lower lending volumes, and use more own resources for lending than borrowing via P2P. This results in higher security for investors and, at the same time, lower interest rates. Extremely responsible lending conditions also result in a particularly small share of overdue loans. Loans with a late status are currently only about 10% on PeerBerry. This shows how responsibly we and our partners manage risks,” – says A. Lekavičius.

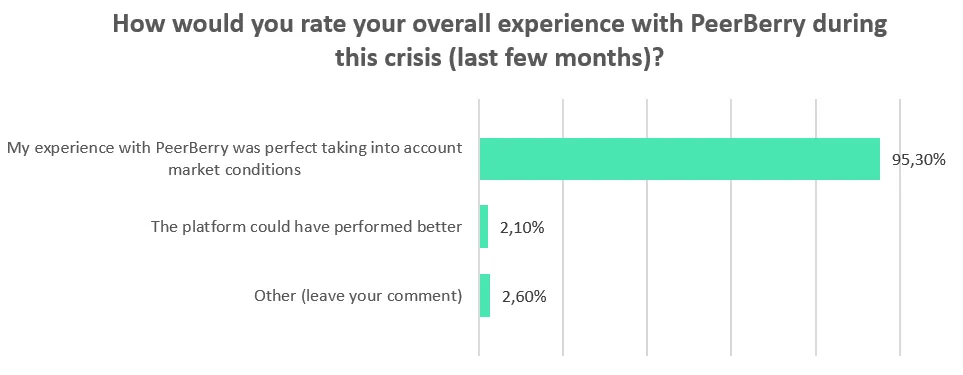

More than 95% of investors value PeerBerry’s performance perfectly

PeerBerry surveyed active investors in May to assess the quality of PeerBerry’s performance during the crisis. 56% of investors who received a survey questionnaire filled it out. This is a high activity rate of survey participants, so survey data can be considered very representative.

According to survey data, more than 95% of investors value PeerBerry’s performance perfectly.

2.1% of investors believe the platform could have worked even better in crisis conditions.

2.6% of respondents left their “thank you” messages or recommendations on what could be improved on the platform.

We also asked our investors how they assess the work of PeerBerry clients’ support. 87% of investors assess the help of PeerBerry as excellent; the rest would like their inquiries to be answered faster. This is especially relevant for those investors who live in other time zones and whose activity time does not coincide with PeerBerry’s business hours.

We care about our investors’ opinion, so we consider all the recommendations and look for a compromise on how one or the other matter could be implemented.

Financial reports of loan originators

In May, PeerBerry began receiving financial statements 2019 for its business partner – loan originators. The financial statement of each loan originator is available publicly on the PeerBerry website, on the page Loan Originators. The financial statements of the following loan originators have already been published:

- https://peerberry.com/originators/credit-plus-ua/

- https://peerberry.com/originators/credit7-md/

- https://peerberry.com/originators/credit365-md/

- https://peerberry.com/originators/slon-credit-ua/

- https://peerberry.com/originators/credit7-ua/

- https://peerberry.com/originators/soscredit-cz/

- https://peerberry.com/originators/euro-groshi-ua/

- https://peerberry.com/originators/zecredit-ua/

- https://peerberry.com/originators/gofingo-ua/

- https://peerberry.com/originators/lithome/

We would like to draw your attention to the fact that almost all financial statements are audited. The audit process is a time-taking process, and it has been further prolonged due to quarantine matters. Translating financial statements from the original language into English also takes time. These are the main reasons why publishing these documents is time-consuming.

We guarantee that all financial statements of PeerBerry loan originators will be made public. That is a fact.

PeerBerry news in May

- New Lithome offer to invest in real estate loan.

- Andrejus Trofimovas, CEO of the main PeerBerry business partner Aventus Group answered questions about how the close partnership between loan originators and PeerBerry helped to protect the interests of investors during the most difficult phase of the crisis.

- Article about PeerBerry loan originator in Moldova.

- Article about PeerBerry loan originator Credit Plus UA.

- PeerBerry April review.