09 June 2023

Adjustments in interest rates from June 15. New lenders are joining the platform.

Dear investors,

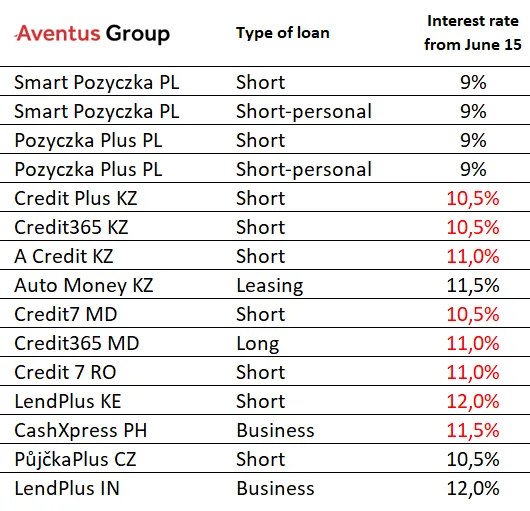

We inform you about the slight decrease in interest rates from June 15 for investing in some loans. Interest on investments in loans from Kazakhstan, Moldova, Romania, the Philippines, and Kenya is decreasing by 0.5%. The decrease in interest rates is based on the lenders’ high profitability and/or limited need to borrow. Please note new interest rates considering your investment strategy.

Interest rates applicable from June 15, 2023:

Please note that adjusted interest rates are applicable for your new investments from June 15 and have no impact on your current investments.

If you have any questions or need our assistance, please get in touch with our Client Support.

New lenders are joining the platform

To cover growing investors’ needs, starting the next week, Aventus Group’s company CashX from Sri Lanka will offer investments in short-term loans again with an 11.5% annual return. A new lender from the Philippines will be onboarded in a few weeks, offering investments in 180-term business loans with 12%. Later this summer and in the autumn, more lenders from different countries will be added to the platform. We will inform investors about each new partner’s investment offer in a separate notice.

Consider additional opportunities to invest in

The demand on the PeerBerry platform is high, and many investors face the issue of investing all the funds held in the PeerBerry account. To avoid a cash drag, please consider investing part of the funds held in your PeerBerry account in the regulated platform Crowdpear, represented by our team.

On the Crowdpear platform, you can invest in property-backed real estate or business loans (primary mortgage) and earn up to 12% annual interest. Crowdpear offers a Secondary market. The Bank of Lithuania supervises Crowdpear’s activities.

Crowdpear currently has 2 550 international investors. The platform manages a portfolio of almost EUR 1 million.

The same shareholders own the PeerBerry and Crowdpear platforms.