04 August 2020

2020 July | stability and expectations

July was very stable on PeerBerry. Platform performance in numbers looks like a reflection of summer vacation mood – no bigger dynamics in data but still there is what interesting to share with you.

Risk management is a key

International markets remain highly cautious and PeerBerry’s business partners continue to apply extremely strict lending conditions. This makes an impact on the volumes of opportunities for you to invest. From the good side, a strict approach to the risk management results in more security for you – the rate of overdue loans on the platform is extremely low. At the end of July overdue loans accounted for only about 10% of total loans. This is probably the best indicator of overdue loans in the entire P2P market.

The main PeerBerry figures for July 2020

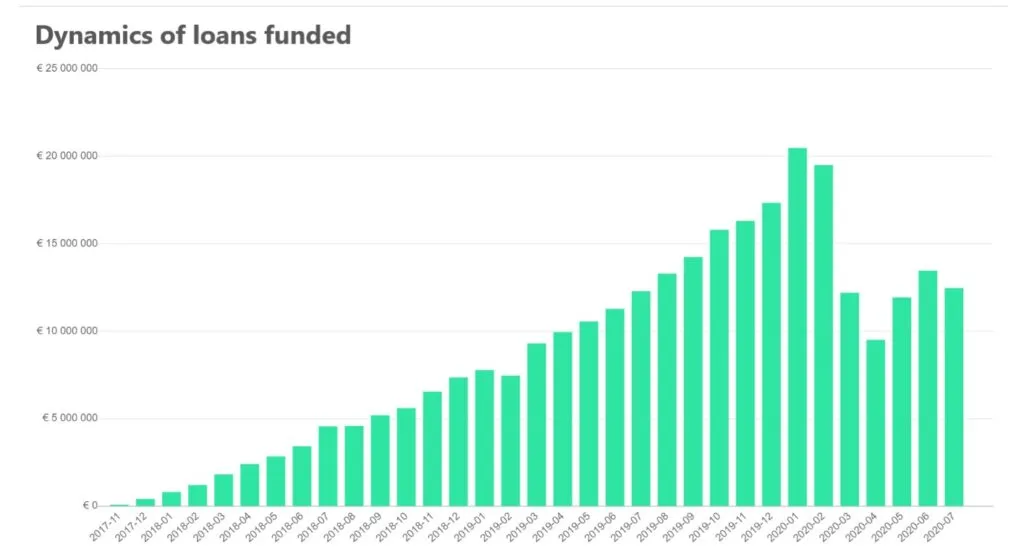

• total loan volume originated since inception – 291 366 048 Eur (+4,5% growth)

• loan volume originated in July – 12.455.678 Eur (-7% vs June)

• number of loans originated in July – 82 956 (+6,7% growth vs June)

• interest earned by investors since inception – 3 225 489 Eur (+6% growth)

• average annual investment return at the end of July – 10.30% (+0.29 pp vs end of June)

• average nominal interest rate of loans originated in July – 10 % (-0.50 pp vs June)

• number of investors at the end of July – 24 737 (+1004 new investors per month)

The amount of loans funded on the PeerBerry platform in July was lower by 7% than in previous month, but the number of loans was higher by almost 6,7% than in June. This shows that PeerBerry loan originators issue more loans but in smaller amounts in order to minimize risks.

“Together with our business partners, we see that markets are becoming more active and in August we expect higher growth in new lending which will bring more opportunities to invest. We also see that there is some uncertainty about the threat of a virus that has not been fully overcome, so risk management remains one of our highest priorities” – says Arūnas Lekavičius, CEO of PeerBerry.

PeerBerry Annual Report 2019

In July, PeerBerry published its Annual Report 2019. In short, in 2019, PeerBerry earned a profit of 0.28 million euros, which is 2.9 times more than in 2018. The size of the PeerBerry loan portfolio grew 3 times in 2019 compared to 2018. In 2019, compared to 2018, the number of PeerBerry clients increased 4 times. More information about PeerBerry’s performance in 2019 and the full Annual Report 2019 you can find on our website https://peerberry.com/peerberry-annual-report-2019/.

Charity

If you invest in loans issued by Aventus Group companies, you are a part of Aventus Group charity programs. In the second quarter of this year, the main PeerBerry business partner Aventus Group provided 30 000 Eur in support for children with serious illnesses. The total charity of the Group during the first half of this year already amounts to 70 000 Eur. More about Aventus Group charity https://peerberry.com/blog/peerberry-business-partner-aventus-group-donated-30-000-eur-to-charity-in-q2-2020/.

New offers from PeerBerry loan originators

In July, PeerBerry added two new loan originators to the platform – Aventus Group company Credit Plus in Kazachstan, which offers investors to invest in short-term loans and a new real estate development partner SI Baltic. More info about Credit Plus KZ https://peerberry.com/blog/new-loan-originator-on-peerberry-aventus-group-introduces-a-new-credit-provider-in-kazachstan-credit-plus-kz/. More about SI Baltic https://peerberry.com/blog/peerberry-introduces-new-business-partner-real-estate-company-si-baltic/.

Coming updates on the platform

We care about investor expectations and are constantly improving the functionality of the platform. In the near future, we will offer investors manual investment improvements, which will allow investors to invest in several loans at the same time. This will ensure a much smoother and faster manual investment process. At the same time, the functionality of Auto Invest and the customer portfolio overview are being improved. In parallel, the PeerBerry mobile application is being developed, which we intend to present to investors this autumn.

Licensing process

As you are informed earlier, the PeerBerry application to receive an Investment Brokerage Firm License is accepted by Latvian regulator FCMC.

The platform is currently actively cooperating with the regulator who reviews the platform’s documents, processes, policies, and everything else that needs to be responsibly assessed before granting a license. It is not yet known exactly when the regulation process of P2P platforms in Latvia will be completed. We will definitely share with you when we have news on the regulation matter.