07 January 2025

In 2024, PeerBerry investors funded EUR 586.11M of loans

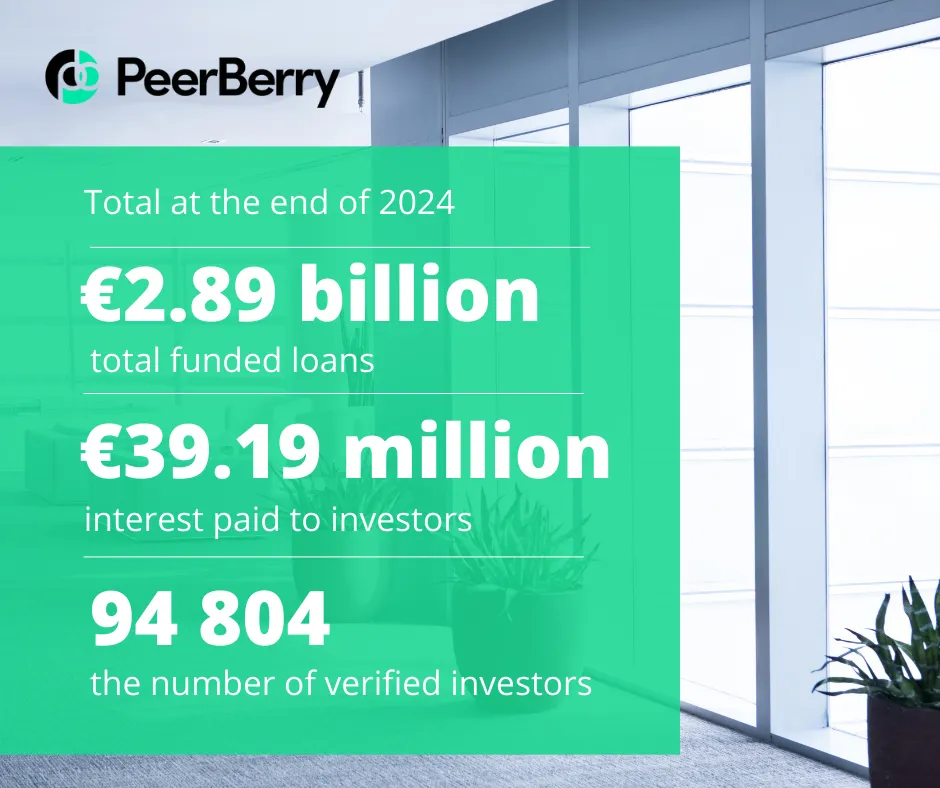

In 2024, PeerBerry investors funded EUR 586.11 million of loans, of which EUR 33.13 million was funded in December. Throughout PeerBerry’s history, investors have funded more than EUR 2.89 billion in loans on the platform.

Last year, PeerBerry investors were paid EUR 11.8 million in interest, of which over EUR 1.2 million was paid to investors in December. Since PeerBerry’s inception, PeerBerry investors have earned EUR 39.19 million in interest.

PeerBerry’s portfolio (the total amount invested) amounted to EUR 117.31 million at the end of 2024.

In 2024, 17 190 new investors joined the platform, with 1 633 joining in December. Currently, PeerBerry has over 94 800 verified users, about 40% of whom are actively investing.

Loan supply

Last year, we experienced a noticeable change in the loan supply, with more longer-term loans coming to the platform than short-term loans. This trend may continue this year; however, PeerBerry, with its partners, will make efforts to increase the volume of short-term loans on the platform gradually.

In 2024, 7 lenders joined PeerBerry: Lend Plus (South Africa), Ecommoney (Kazakhstan), Credito365 (Colombia), Ultradinero (Mexico), Acredit (Romania), NovaLend (Poland) and Findom (Kazakhstan). Currently, 23 loan originators from 12 countries offer to invest in loans on the PeerBerry platform.

In Q1 2025, we plan to onboard new lenders from Nigeria and South Africa. The loan volumes of some existing partners are intended to grow, potentially increasing the platform’s loan supply.

Full settlement in war-affected loans

Last year, PeerBerry closed a significant chapter in the platform’s history by repaying EUR 51.4 million (including accrued interest) in war-affected loans. This milestone made PeerBerry the first and only investment platform in the market to meet its war-affected obligations to investors fully.

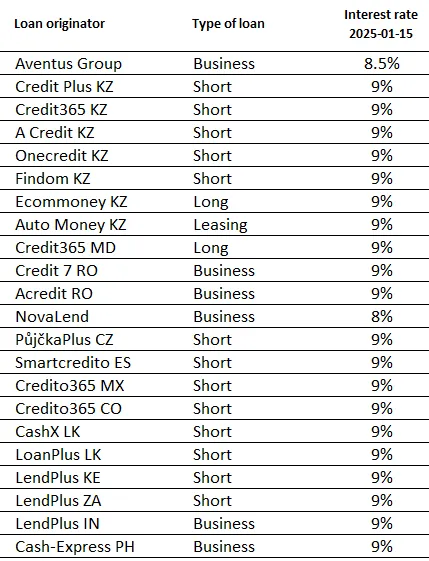

Adjustments in interest rates from January 15, 2025

We inform you about the changes in interest rates for investing in loans from January 15. Please note the highest (9%) and lowest (8%) interest rate margins, considering your investment strategy and setting the AutoInvest.

Adjusted interest rates are applicable for your new investments from January 15 and have no impact on your current investments.

If you have any questions or need our assistance, please contact our Client Support.