12 May 2020

PeerBerry loan originator Credit Plus UA predicts a profitable year 2020

Ukrainian company Credit Plus is one of the most successful Aventus Group companies, which profit in 2019 was 13 times higher in comparison with 2018. We invite you to review an audited Financial statement 2019 of Credit Plus in the page Loan originators in our website.

Founded in 2017, Credit Plus started to list a part of its loans on PeerBerry at the end of 2018. The company is listed in the register of Financial Companies and is a member of Ukrainian Association of Financial Companies. The clients of Credit Plus are highly satisfied with a professional and highly innovative services that meet today’s needs.

Credit Plus is headed by Volodymyr Dovgal. He works for Aventus Group for 3 years and has more than 14 years of experience in banking. We asked Volodymyr to share information about performance of Credit Plus in 2019 and what business perspective he sees this year.

What are strong sides of Credit Plus company in the Ukrainian market? What distinguishes the company from competitors in the market? What place does the company occupy in the market?

Our company is relatively young, established in 2017. In 2019, only two years have passed since the issuance of the first loan, but we are confidently entering the TOP-5 companies in the Ukrainian market in all key indicators. We also are among the three most profitable companies on the market. The specific feature of our company from the very beginning was the combination of modern technology and a high level of service for our clients, which allowed our brand to gain popularity. As a company manager I can say with the confidence, that CreditPlus team is one of the best in Ukraine.

For what needs do your clients most often take loans from the company you represent? What is the average loan amount?

Most often our clients take loans for small or unexpected purchases, like buying some stuff for home, gifts, for repairing the car etc. We issue loans for a period of 3 to 30 days in the amount of 500 to 15 000 UAH (from 17 to 515 Euros), but the average loan amount in our company is about 3200 UAH (110 Euro).

What was the year 2019, what achievements can you be proud of?

2019 was a very dynamic year. Our company has grown more than 3 times in all key indicators and has become one of the largest and most profitable companies in the Aventus Group. The profit was sufficient to ensure high growth rates of the company with a minimum amount of external borrowing. The need to raise funds was mainly associated with the need to ensure rapid growth in the 3rd and 4th quarters of 2019.

What were the company’s results in the first quarter of this year, and what further perspective do you see this year, evaluating all the recent developments in the market? What trends do you predict in the Ukrainian market?

In the first quarter of this year we reached record sales, issued a millionth loan. But after the announcement of quarantine, the picture has changed significantly – in the face of uncertainty, we had to tighten risk scoring settings, limit advertising activity and reduce lending. Thanks to early response and strict quarantine, Ukraine managed to cope with the threat of coronavirus, but clients’ behavior has changed a lot – Ukrainians have become very careful about lending and attracting new clients has become much more difficult. Despite the decline in lending, we plan to maintain the company’s profitable work in 2020.

Visit Credit Plus on https://creditplus.ua/

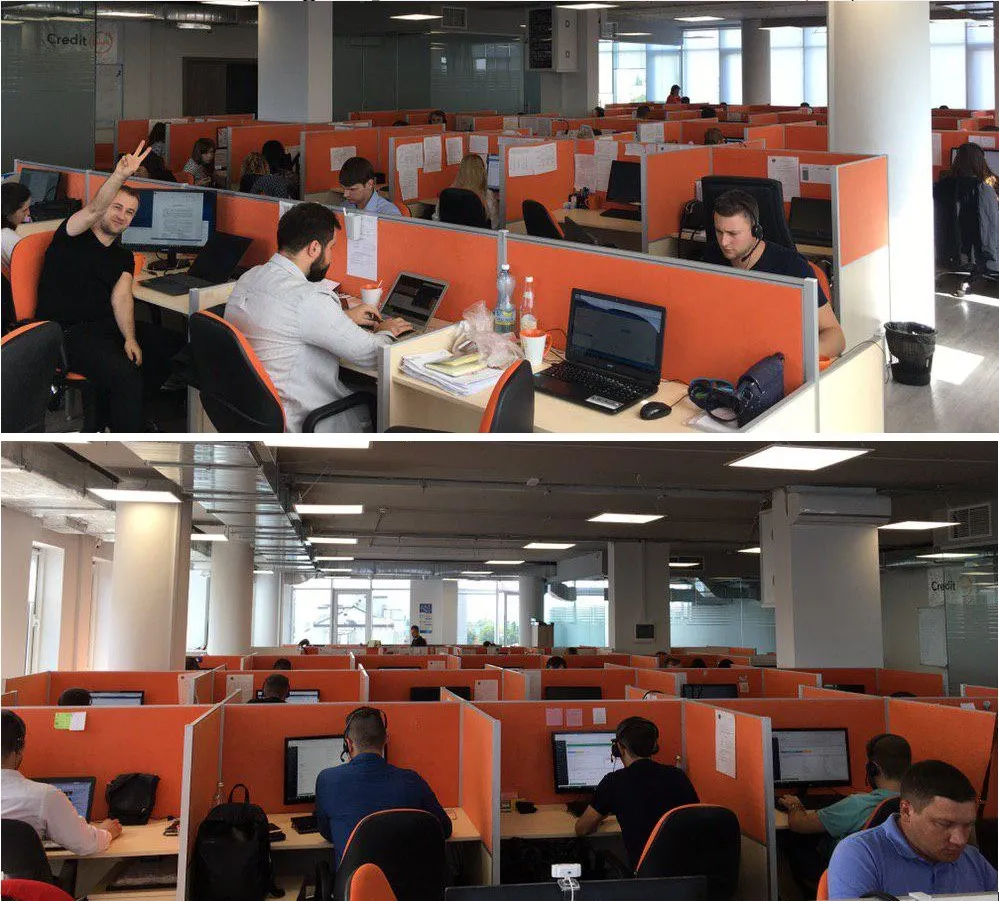

Credit Plus has 178 employees in Ukraine. Few moments from the Credit Plus office: