05 February 2020

PeerBerry marks notable growth in January 2020

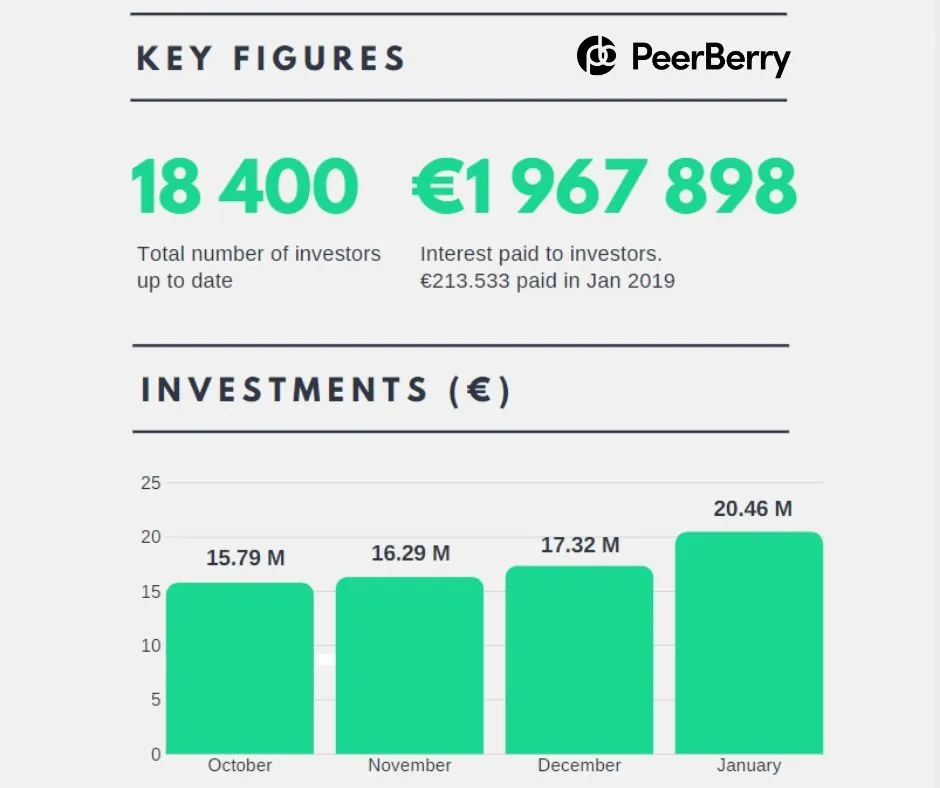

During January this year, 1,400 new investors have joined to the PeerBerry investors community – 20% more than in previous months. PeerBerry currently has more than 18 400 investors who are enjoying investment opportunities at PeerBerry.

The main PeerBerry figures for January 2020:

- total loan volume originated since inception – 212 368 915 Eur;

- loan volume originated in January – 20 462 468 Eur;

- number of loans originated in January – 83 786;

- average nominal interest rate of loans originated in January – 11.55%;

“We are happy to share that January 2020 was marked by a very positive growth at PeerBerry. We have unquestionably become the No 2 P2P platform among other market players in continental Europe. Last month we gained a much higher number of new investors than in previous months, the amount of funded loans – new investments per one month grew up by almost 20 %” – states Arūnas Lekavičius, CEO of PeerBerry.

“At PeerBerry we are guided by a high-level of business ethics and transparency, our work is based on respect for our investors. Through honest communication with our clients, risk management and tight cooperation with our partners we strive to be a leading example and best practice across all the P2P industry. The growing number of clients only proves that investors value it” – says A. Lekavičius.

“Last month we received a lot of questions from investors on what we think about Kuezal and Envestio cases. Investing is a service that requires high transparency and trust. Cases of these two platforms that cause investors’ concerns discredit the whole P2P industry. I sincerely hope that transparency and accountability to investors will become a necessary norm for every P2P platform and there will be all necessary mechanisms put in place to prevent such cases in the future” – explains A. Lekavičius.

P2P platforms ranking according to loan volume in January 2020