26 March 2020

PeerBerry business partners are fully capable to overcome economic downturn

The operational health of each P2P platform is very closely linked to their partners – loan originators. Depending on how professionally the business of loan originators is managed, what is the focus on risk management and what is the financial capability of the partners, this all has a direct impact on the reliability and stability of the P2P platform as well.

PeerBerry cooperates with three business partners:

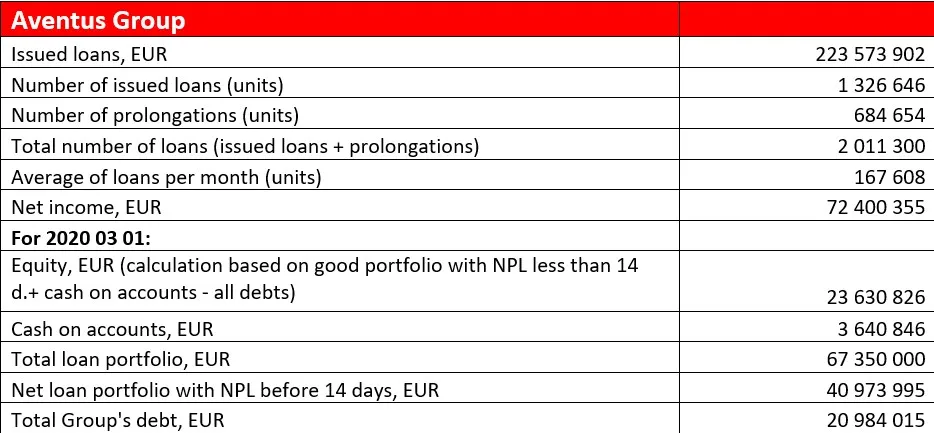

- Aventus Group – share of loans on PeerBerry amounts 80%;

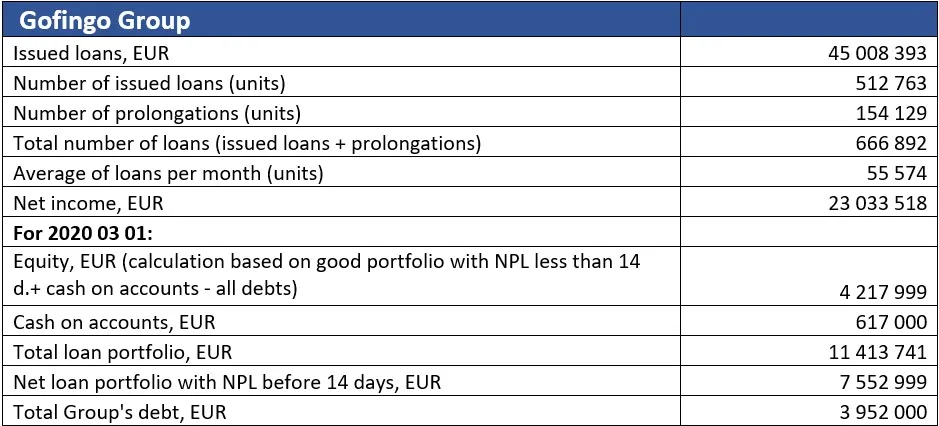

- Gofingo Group – 15% share of loans;

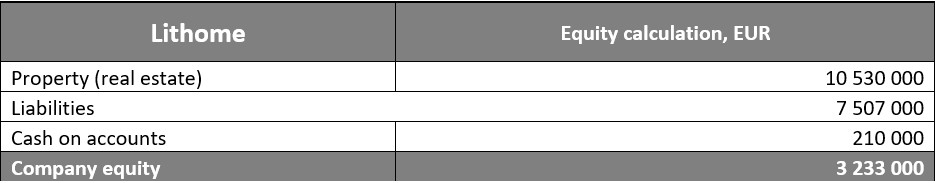

- Lithome – 5% share of loans on PeerBerry.

Let’s look at the key performance figures of each PeerBerry business partner for the date 1st of March 2020 (1st of March 2019 – 1st of March 2020):

The Net loan portfolio of Aventus Group and Gofingo Group is more than twice higher than the debt of these companies. This proves that PeerBerry business partners are fully capable of covering all the liabilities to investors.

As it was announced earlier this month, in response to recent developments in international markets, PeerBery and its partners made following adjustments in business strategy on purpose to maintain business sustainability and to ensure investors protection. Read more information here.

In the light of recent global challenges, the management of PeerBerry, Aventus Group and Gofingo Group took responsible decision to apply an additional Group guarantee to all loans issued by Aventus Group and Gofingo Group to enhance an additional investments security for PeerBerry investors. More about additional Group guarantee read here.

In the beginning of this year Aventus Group, Gofingo Group and Lithome have announced preliminary financial results of 2019. As it was officially stated in the announcements, we plan to have financial statements of 2019 ready till the end of H1 of 2020. Financial statement of each loan originator, which participate in P2P, will be published on PeerBerry website.