07 October 2020

PeerBerry brand is perceived as very reliable and stable. The platform is being rated higher than the P2P market

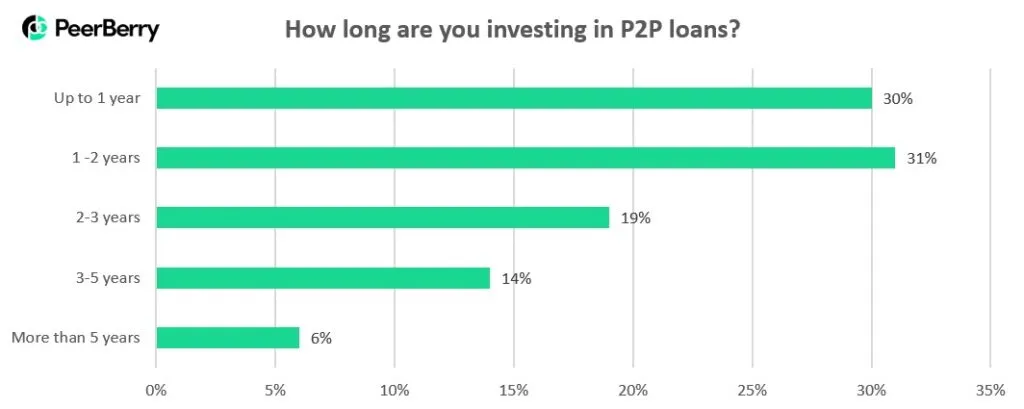

The PeerBerry brand is perceived by most investors as a reliable and stable. This is shown by the latest PeerBerry investor survey, which involved 2,975 investors from 40 countries. The survey was conducted on September 24-28.

In the survey, we asked investors what first thought comes to mind when thinking about PeerBerry. Most investors mentioned that PeerBerry is reliable and stable (more than 300 mentions for each keyword in the survey). A lot of investors also distinguished safety and professional communication with investors. Many mentioned that the platform is trustworthy, serious, solid, simple, and easy to use. These keywords were mentioned more than 100 times in the survey.

Given the fact that the PeerBerry brand is one of the least advertised in the market, such a brand perception as reliable and stable is a huge appreciation for us. Investors give us such an assessment purely based on their experience with PeerBerry.

There were also product-based mentions in the survey, such as investments, short-term loans, buyback, Auto Invest. Some investors feel risks and uncertainty, which is very understandable because investors invest in several platforms, have different experiences and that experience is not equally good everywhere.

There are mentions related to necessary platform improvements like slow, improvable, or #alotworkshouldbedone. And we agree with it! Nothing is perfect and only by improving we can achieve a better result.

PeerBerry is rated higher than the P2P market

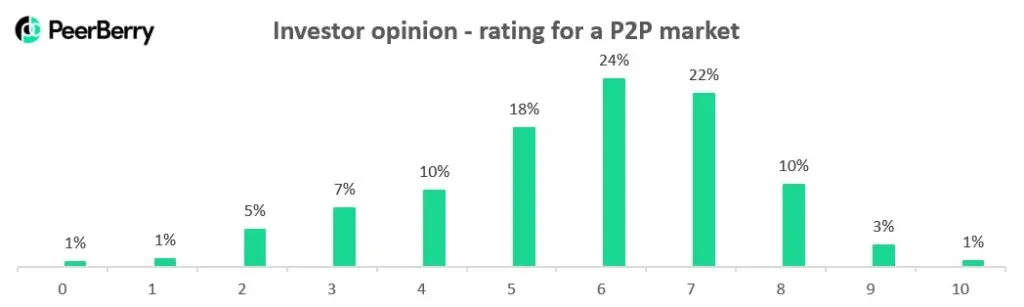

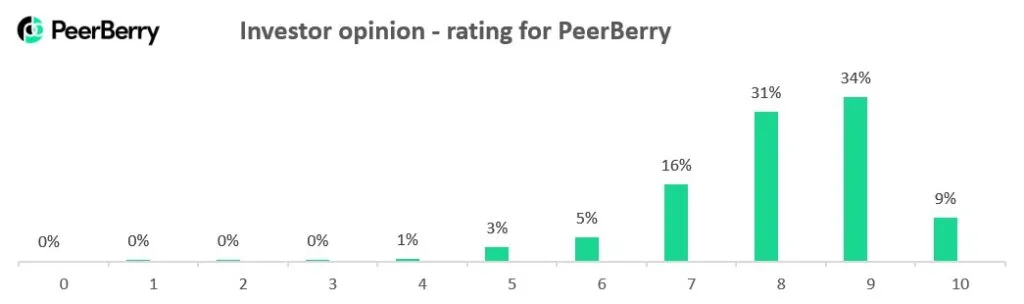

The survey also revealed that the PeerBerry platform is being rated much higher than the entire P2P market in general. P2P market is rated by 6-7 points, while most investors gave 9 for PeerBerry. Investors were asked to rate the P2P market with a score from 0 to 10, as well as the PeerBerry platform.

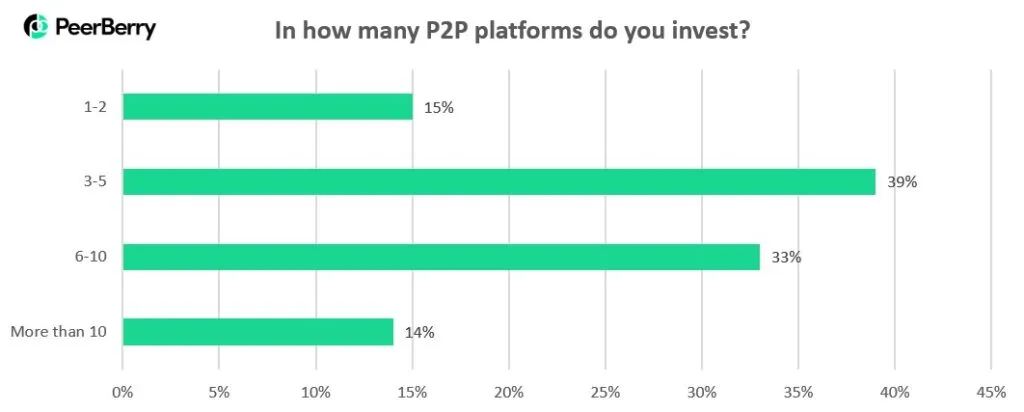

The difference between the P2P market rating and the PeerBerry rating can be explained only by the experience of our investors. Most investors are investing in multiple P2P platforms and can compare their experiences. The higher score for PeerBerry’s is given due to the very stable performance, timely and transparent communication, no one investor has ever lost their investments on PeerBerry. PeerBerry does not impose any fees or restrictions on investors. There are no pending payments or defaulted loans on the platform. The ratio of late loans on PeerBerry is about 15-20%, and it is one of the best loan quality indicators in the entire market.

Speaking about the P2P market in general, many investors are very disappointed due to the fraudulent activities of some platforms known as scam cases where investors have lost their investments.

The first part of PeerBerry’s survey, which shows that most investors were not affected by the pandemic, can be viewed here.