28 June 2021

Large investors in PeerBerry are growing the most

Quite often we hear or see in external sources written that PeerBerry is a great choice for beginners. We agree with this statement, but only from the point of view that the PeerBerry platform is very simple to use.

So, which investors are choosing the PeerBerry platform? Let’s go through the statistics.

Who invests in PeerBerry?

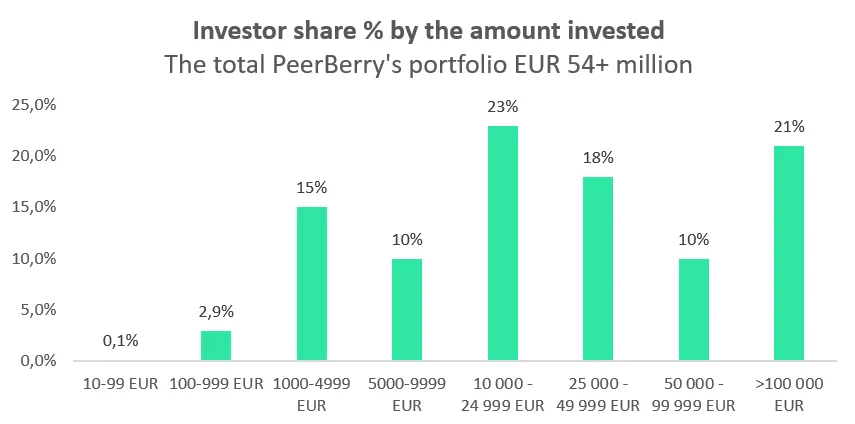

PeerBerry’s total portfolio currently is EUR 54+ million. According to the monthly volumes of funded loans, PeerBerry is the second-largest alternative investment platform in Europe. Let’s analyze what investors make up PeerBerry’s portfolio by categories of amounts invested.

According to the actual data (the graph above), the largest part of Peerberry’s portfolio consists of investments between EUR 10 000 and EUR 25 000 (23% of the total portfolio) and investments above EUR 100 000 (21% of the total portfolio). Investments from EUR 25 000 to EUR 50 000 make up 18% of the total portfolio. Investments from EUR 1 000 to EUR 5 000 make up 15%, investments from EUR 5 000 to EUR 10 000 and from EUR 50 000 to EUR 100 000 make up 10% of each category.

Roughly speaking, most investments on PeerBerry start at EUR 1 000. Retail investors (from EUR 10 to EUR 100) represent only 3% of the total portfolio.

PeerBerry investor growth (January-June 2021)

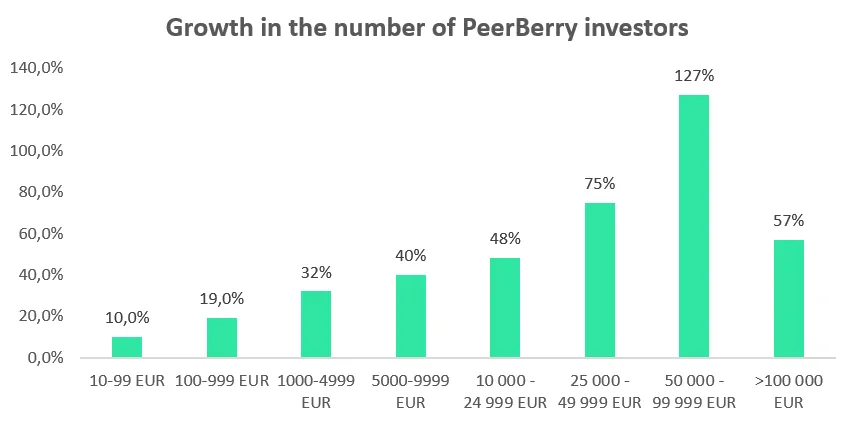

The total number of active PeerBerry investors grew by 30% from the beginning of this year to the end of June. Active investors mean not registrations but fully verified clients with active investments from 10 EUR.

The highest growth of investors was in categories from EUR 50 000 to EUR 100 000 (+127%), from EUR 25 000 to EUR 50 000 (+75%), and in the category over EUR 100 000 (+57%). The increase in categories from EUR 10 000 to EUR 25 000 and from EUR 5 000 to EUR 10 000 was also quite high – plus 48% and 40% accordingly.

Both new and existing investors have been actively increasing their portfolios on PeerBerry. In the first half of this year, the portfolios grew the most in the categories of EUR 50 000 – 100 000 (+ 132.2% growth) and EUR 25 000 – 50 000 (+ 72.5% growth). Portfolios in the EUR 10 000 – 25 000 category increased by +47%, portfolios in the categories above EUR 100 000 and EUR 5 000 – 10 000 increased by + 38%.

Geography

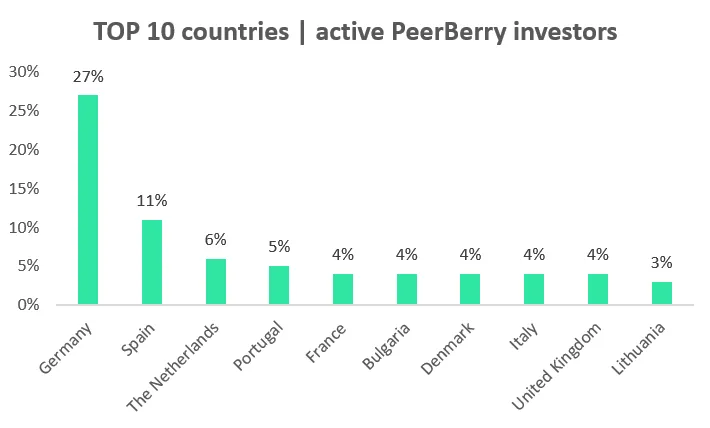

The distribution of PeerBerry investors by country since the inception of the platform is quite similar. The largest number of active investors in PeerBerry’s portfolio are from Germany, Spain, and the Netherlands.

It is interesting to note that the share of active investors from France has increased significantly this year. Earlier this year ranked 16th, France is currently ranked 5th in the TOP 10 countries. There has also been a significant increase in investors from Greece. The Greeks rose from 17th to 12th position in the PeerBerry client portfolio.

The age of investors

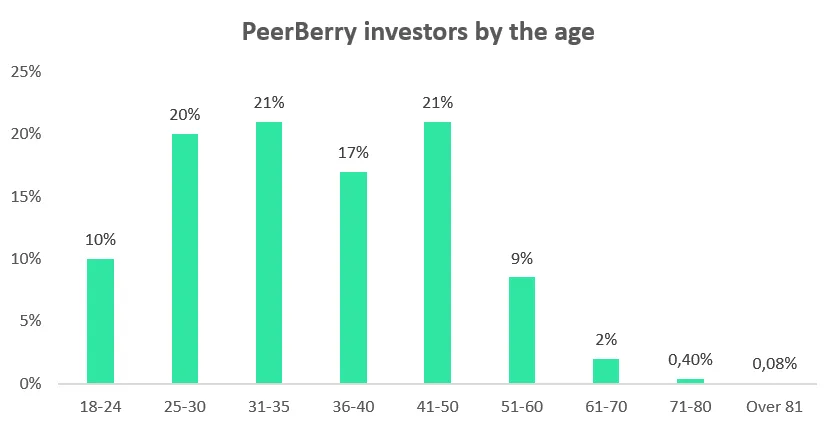

The majority of active PeerBerry investors are investors between the age of 25 and 50.

Diversification aspect

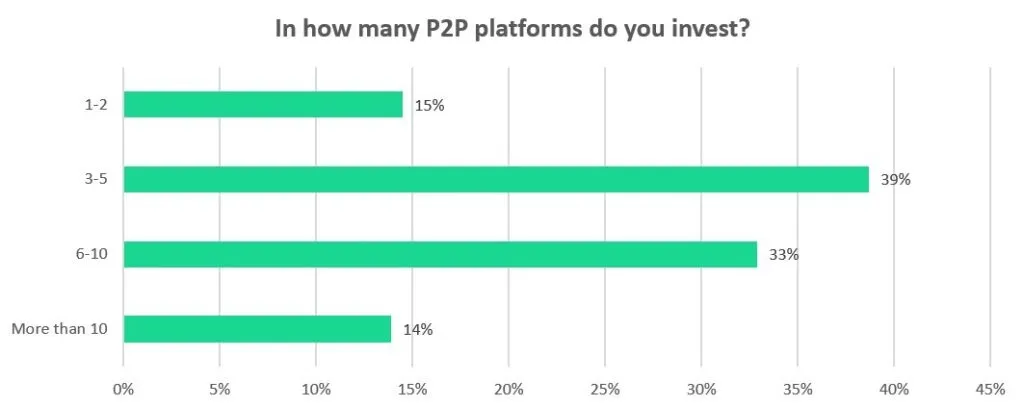

A survey conducted last year showed that most PeerBerry investors are diversifying their investments by investing in multiple platforms. Moreover, a large proportion of investors allocate their investments to different types of investment/asset classes. Which means investors aren’t beginners.

CONCLUSIONS

- large investments show high investor confidence in the platform,

- PeerBerry is a platform for everyone older than 18, who meets the requirements to invest in PeerBerry, and who appreciates our services,

- PeerBerry is a great choice in the investment portfolio when diversifying investments across different asset classes.