05 January 2021

PeerBerry grew by 50% in 2020

2020 was an exceptional year for PeerBerry. The platform reached almost 50% growth in 2020.

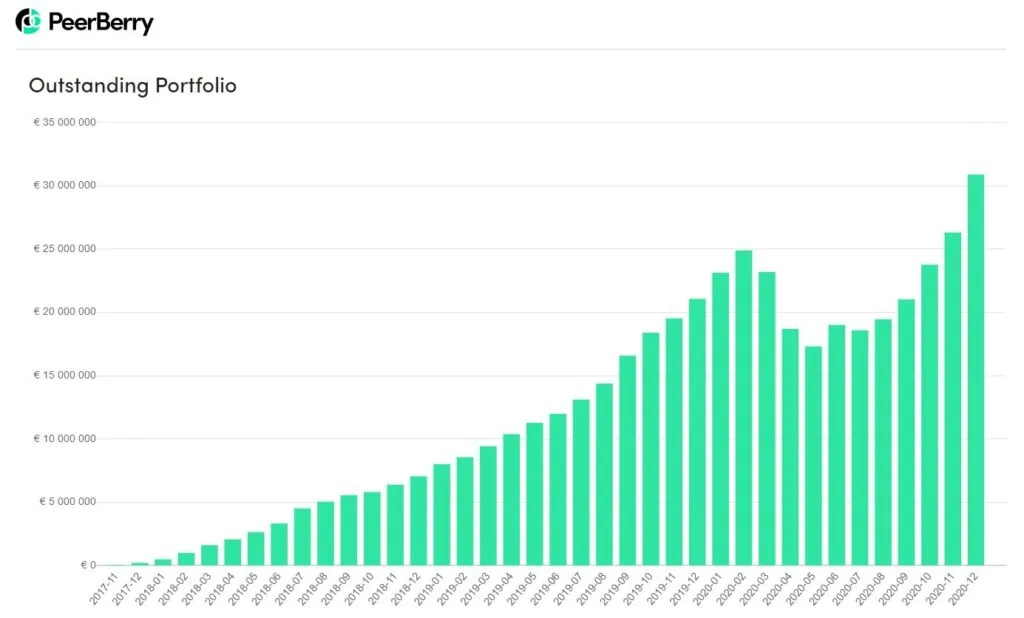

The loan portfolio of PeerBerry grew by 46% last year – from 21,06 million EUR at the end of 2019 to 30,88 million at the end of 2020.

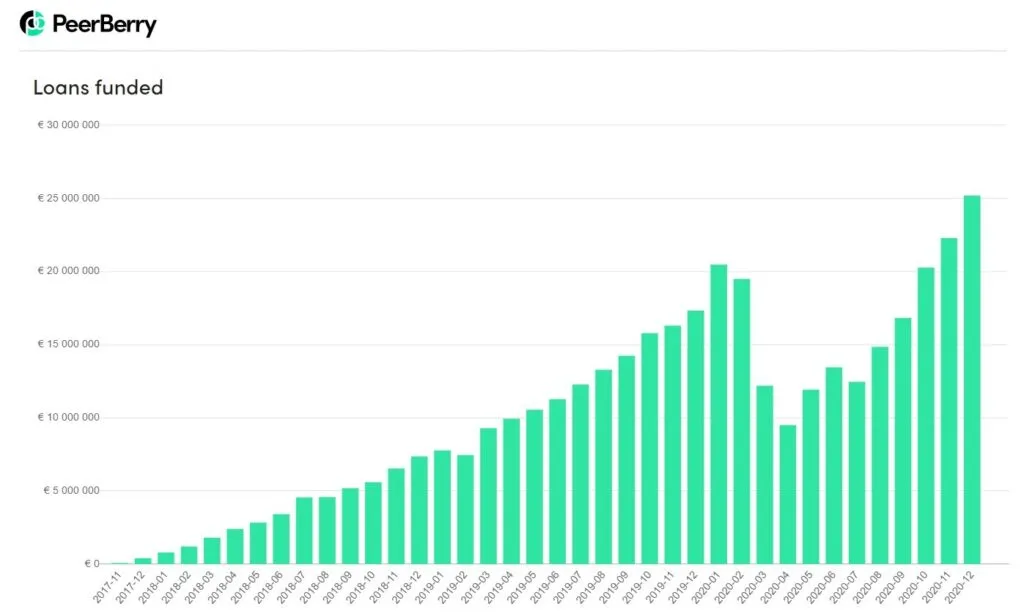

In 2020, PeerBerry investors funded 198,83 million EUR amount of loans, i.e. 36% more than in 2019.

The number of PeerBerry investors grew by 74% in 2020 – from 17 046 at the end of 2019 to 29 571 at the end of 2020.

In 2020, PeerBerry paid 2,45 million EUR in interest to its investors, i.e. 73% more than in 2019.

The platform demonstrated outstanding performance during all the challenges 2020 brought to us all. None of PeerBerry’s business partners faced any financial or operational difficulties last year. All PeerBerry partners were responsibly fulfilling their obligations to investors. PeerBerry investors have never experienced any defaulted loans or pending payments. The platform has communicated proactively and openly with investors, and all this has made PeerBerry one of the most trusted platforms in Europe.

The main PeerBerry figures for the end of December 2020

- the total loan volume originated since inception – 390 732 156 EUR (+6.8% growth)

- the loan volume originated in December – 25 172 789 EUR (+13% vs November)

- the number of loans originated in December – 135 559 (-10% vs November)

- the interest earned by investors since inception – 4 214 610 EUR (+6.5% growth)

- the average annual ROI at the end of December – 12.35% (+0.21 pp vs November)

- the average nominal interest rate of loans originated in December – 12% (+0.15 pp vs November)

- the number of investors at the end of December – 29 571 (+1144 new investors per month)

“The year 2020 was exceptional in every aspect of life. It was a challenging time. At the same time, the year was very interesting. We have achieved a great result, but that does not mean that those results have come by themselves. Seeking the best result, we put a lot of effort together with the team. Last year, together with our business partners, we reviewed business processes and risk management processes. Our close and open cooperation with partners has ensured stability and smooth operation in crisis conditions. Once again, I thank our investors for their partnership and trust in us” – says Arūnas Lekavičius, CEO of PeerBerry.

“Our main priorities this year are to complete the regulatory process and obtain an IBF license. Together with our business partners, we will continue ensuring the quality of our services and full protection for our investors. We will further improve our platform and offer our investors new products and investment opportunities” – notes A. Lekavičius.