18 January 2022

Credit7 RO joins PeerBerry | adjustments in interest rates

Credit7 from Romania joins the PeerBerry platform today. A new business partner will offer investors short-term loans with an 11% annual return. Credit7 RO activities are supervised by the National Bank of Romania. Loans on PeerBerry include a buyback and a group guarantee.

“Seeking broader diversification in geography, today we are onboarding Aventus Group company Credit7 from the EU country Romania. Our partners plan further expansion in their current and new markets, so in the first quarter of this year, we will add more new partners to ensure more diverse opportunities to invest for our investors” – says Arūnas Lekavičius, CEO of PeerBerry.

If Credit7 RO offer meets your investment strategy, make sure to include this company in your Auto Invest strategy. First loans from Credit 7 RO will be uploaded on the platform this week.

About Credit7 RO

Credit7 RO (legal name AVENTUS GROUP I.F.N. S.A.) is a non-bank lending company in Romania that provides customers with online short-term (up to 30 days) loans.

The company is working to make short-term loans more affordable to the citizens of Romania. Credit7 RO cares about customer experience, so the company strives to eliminate many bureaucratic elements that can be resolved faster by using technologies.

Credit7 RO was founded in May 2021. Currently, at Credit7 RO work 10 employees.

Company’s website https://credit7.ro/.

Adjustments in interest rates from January 24

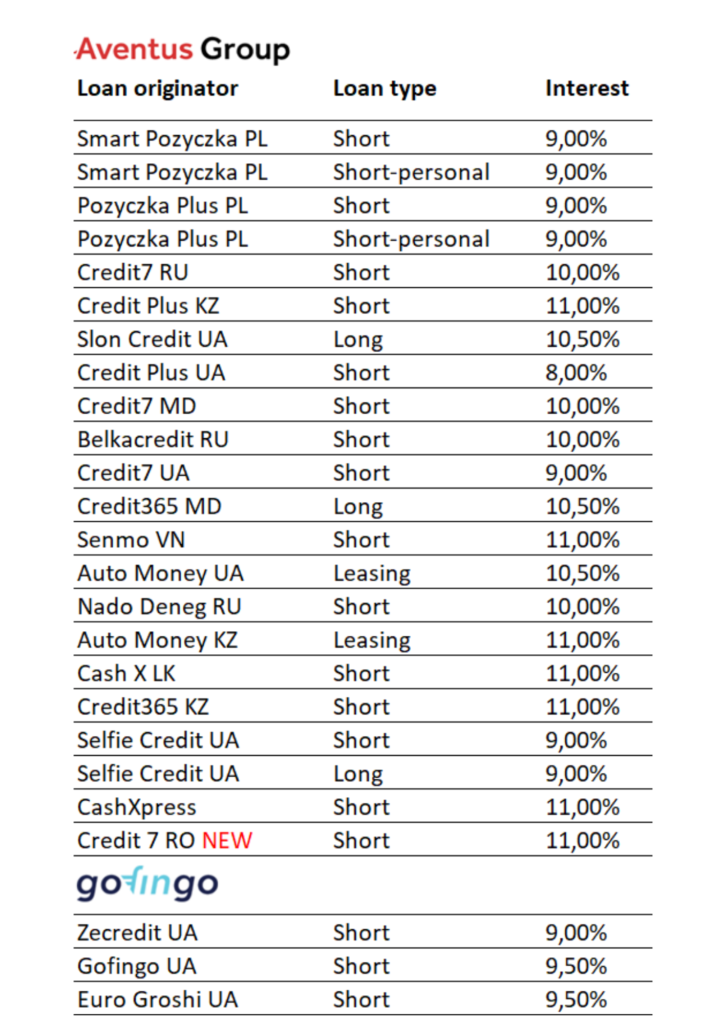

We want to draw your attention to some adjustments in the interest rates on the PeerBerry platform from January 24. Please note the lowest (8%) and highest (11%) margins of the interest rates and adjust your Auto Invest strategies accordingly.

“The first months of the year in the lending business (both banking and microfinancing) are statistically the least productive months in terms of loan volumes. Our partners have earned significant profits last year, most of their loans are being issued using their own funds. The lower need to borrow is the main factor that has a temporary effect on supply and interest rates level in our platform. Loan issuing will grow in nearest months, we will add more business partners and the supply in our platform will be correspondingly higher” – explains Arūnas Lekavičius.

Interest rates applicable from January 24:

Adjusted interest rates are applicable for new investments done from January 24 and have no impact on your current investments.