04 September 2020

2020 August | The best results in the last six months

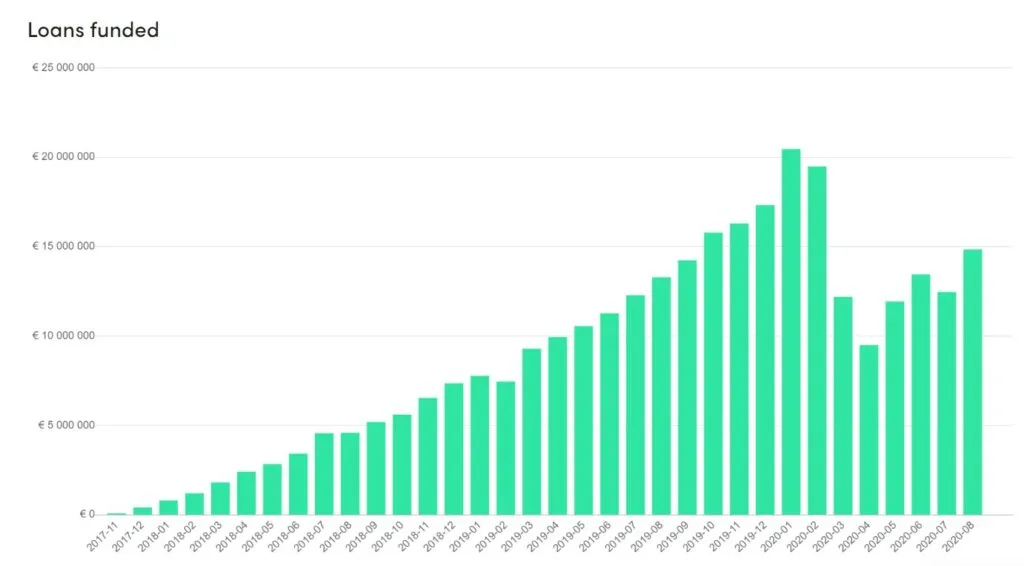

According to the PeerBerry results, August is the most productive month in terms of funded loans on the platform since February, when the global pandemic turmoil began. During August, the amount of 14.84 million EUR of loans was funded through the platform, which is 19% more than in July. According to the volume of loans funded through the platform, PeerBerry is one of the strongest leaders among all P2P platforms in Europe.

The main PeerBerry figures for August 2020

- the total loan volume originated since inception – 306 210 231 Eur (+5% growth)

- the loan volume originated in August – 14 844 183 Eur (+19% vs July)

- the number of loans originated in August – 103 568 (+25% growth vs July)

- the interest earned by investors since inception – 3 374 284 Eur (+4,6% growth)

- the average annual investment return at the end of August – 10.14% (-0.16 pp vs end of July)

- the average nominal interest rate of loans originated in August – 9.7 % (-0.30 pp vs July)

- the number of investors at the end of July – 25 475 (+738 new investors per month)

“We see that the threat of a pandemic has not gone away, but we also see that both businesses and people have adapted to this circumstance and are responding to it more calmly. New lending is growing steadily what brings positivity and more opportunities to our investors” – says Arūnas Lekavičius, CEO of PeerBerry.

“Together with our partners, we further responsibly assess the situation in all markets every week and thoroughly review borrowers’ performance indicators. We are pleased to continue to maintain high-quality performance in cooperation with our loan originators. The total share of overdue loans in PeerBerry’s portfolio was 12% in August. Loans for which a buyback guarantee was required to apply on our platform were only up to 1% of the total portfolio. This is one of the best quality indicators in the whole P2P market” – explains A. Lekavičius.

Responding to the requests of investors to have a greater choice of longer-term and stable loans on the platform, in August PeerBerry together with its’ business partner Gofingo Group offered business loans – an attractive solution for both business and investors. Currently, short-term loans account for 65% of all loans in PeerBerry’s portfolio, long-term loans for 10%, car leasing loans for 13%, real estate loans for 6%, and business loans for 6% of the total portfolio.

New updates on PeerBerry

In August, PeerBerry implemented the first stage of the manual investment tool update – additional filters were introduced that made the manual investment process more efficient. The manual investment tool is being further developed. Within the coming month, the opportunity to invest in multiple loans at the same time will be implemented.

Additional charts were added on the statistics page on the PeerBerry website https://peerberry.com/peerberry-statistics/. You can now see what share of the outstanding loan portfolio on PeerBerry takes both the group as a whole (Aventus Group, Gofingo Group, Lithome, and SI Baltic) and each loan originator separately. Investment statuses (current/late) are also available to review by choosing each loan originator.