01 April 2022

March 2022 | PeerBerry passed one more business resilience exam

Wow (or OMG) – what month was March 2022. On the one hand, it was like a déjà vu “We have already seen it. We have already been there” (when remembering a huge panic during the first wave of covid in March 2020). On the other hand, nothing compares with the current events. Nothing. People are dying in Ukraine. Profitable businesses in Ukraine have been paralyzed. No withdrawals/transfers from Ukrainian and Russian accounts are possible right now. A part of our investors’ investments is temporarily stuck in Ukrainian and Russian accounts. March was like an emergency landing when both engines are on fire (one engine – Ukrainian market, another engine – Russian market).

The events of the last month have required us to take immediate and well-coordinated actions in reviewing all business processes and managing the overall panic due to the war in Ukraine. But – today, we can celebrate a positive daily balance on PeerBerry, which is a victory in the current situation.

Key figures for the end of March 2022 (vs February 2022)

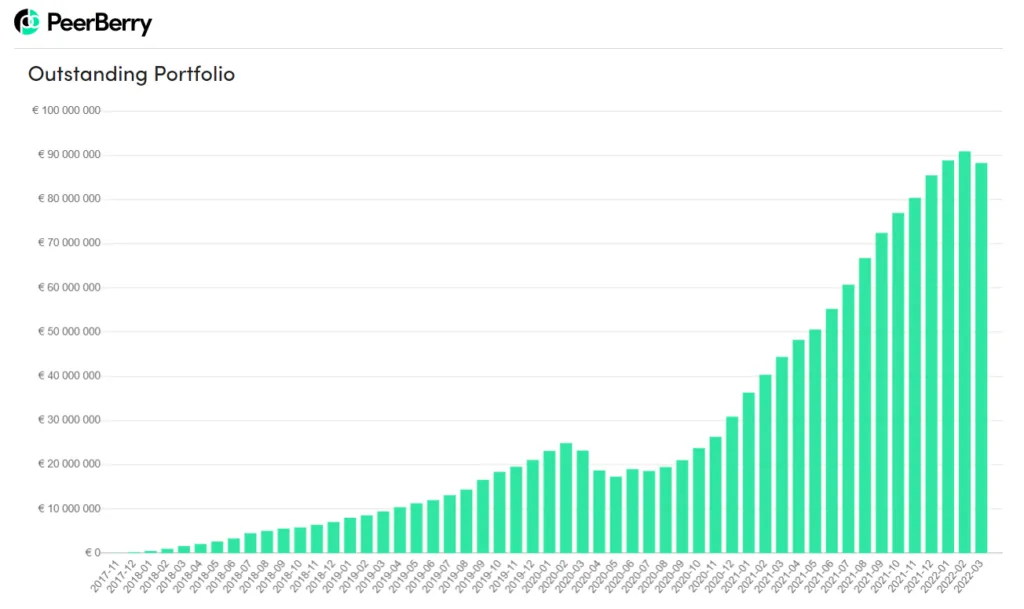

- PeerBerry’s total portfolio at the end of March: EUR 88 215 129 (-3%↓)

- total loans funded (cumulative since inception): EUR 1 112 931 609 (+2% ↑)

- the loan volume funded in March: EUR 24 162 035 (-61%↓)

- the interest earned by investors since inception: EUR 12 496 440 (+5% ↑)

- the interest paid to investors in March: EUR 534 825 (-17%↓)

- the average annual ROI at the end of March: 10.90% (no change vs February)

- the number of investors at the end of March: 53 488 (+1019 ↑)

“I will not repeat that this March was incomparably turbulent, but there is something to compare looking at our historical performance. For example, the overall withdrawal amount this March was EUR 5.97 million. Compared to April 2020, when we experienced the biggest hit during the first covid wave, the withdrawal amount was EUR 5.83 million. Comparing the current volume of our portfolio to what it was two years ago, we have now experienced much smaller withdrawals. In 2020, during the first wave of covid, we had a negative balance for several months. Now we returned to a positive balance in three weeks. We see that a part of our investors who withdrew their funds from the PeerBeery platform at the beginning of the war, now are returning and investing again. In March, we funded 61% less new loans than in February, which is normal due to the panic caused by the war, and we lost two lucrative markets – Ukraine and Russia, which means that we lost part of new loans volumes, respectively. Within March over 1000 new investors have joined PeerBerry, and the amount of new deposits is growing daily. Together with our partners we have successfully managed this crisis caused by the war and now we can continue to work on focusing on our partners’ profitable business and on the smooth implementation of the repayment of war-affected loans,” – says Arūnas Lekavičius, CEO of PeerBerry.

Our communication in March 2022:

March 7: Russia-Ukraine War| PeerBerry’s actions in response to the war impact

March 8: PeerBerry partners are increasing interest rates

March 9: Aventus Group | Andrejus Trofimovas addresses investors on the war’s impact on business

March 13: P2P Empire | How Aventus Group is prepared to overcome challenges caused by war

March 14: Aventus Group in Poland earned EUR 6.96 million in net profit in 2021

March 15: PeerBerry business partners deliver projections of the repayment of war-affected loans

March 16: Q&A | War-affected loans – what is important to know

March 22: EUR 8,7 million of war-affected loans have been repaid | Next repayment – in April

March 24: In 2021, Aventus Group’s business in Kazakhstan grew more than 3 times

March 29: Extraordinary March was profitable for Aventus Group

February 2022 statistics (vs January 2022)

- PeerBerry’s total portfolio at the end of February: EUR 90 837 673 (+2.3% ↑)

- total loans funded (cumulative since inception): EUR 1 088 769 574 (+6% ↑)

- the loan volume funded in February: EUR 61 927 570 (-11%↓)

- the interest earned by investors since inception: EUR 11 961 615 (+6% ↑)

- the interest paid to investors in February: EUR 645 219 (-14%↓)

- the average annual ROI at the end of February: 10.90% (no change vs January)

- the number of investors at the end of February: 52 469 (+1514 ↑)