04 January 2022

PeerBerry grew almost three times in 2021

2021 was the year of outstanding growth for PeerBerry. The platform has almost tripled within the previous year.

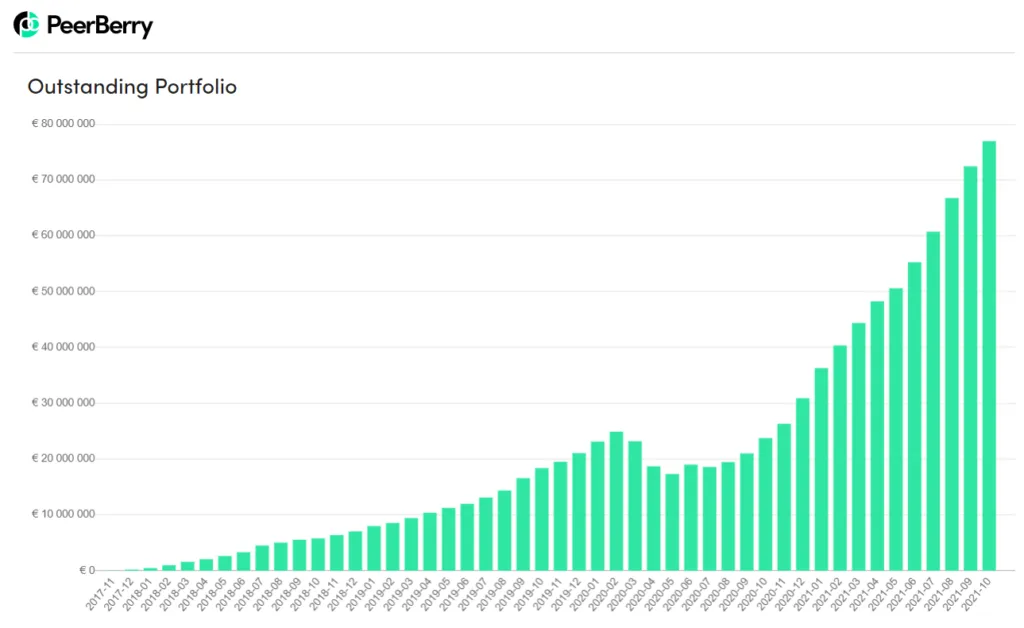

PeerBerry loan portfolio

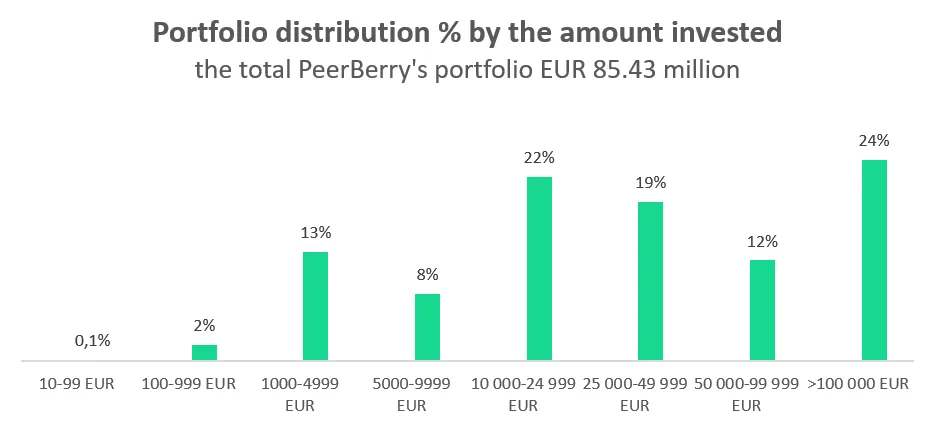

In 2021, PeerBerry’s loan portfolio grew 2.77 times or 177% exceeding EUR 85.43 million at the end of the year.

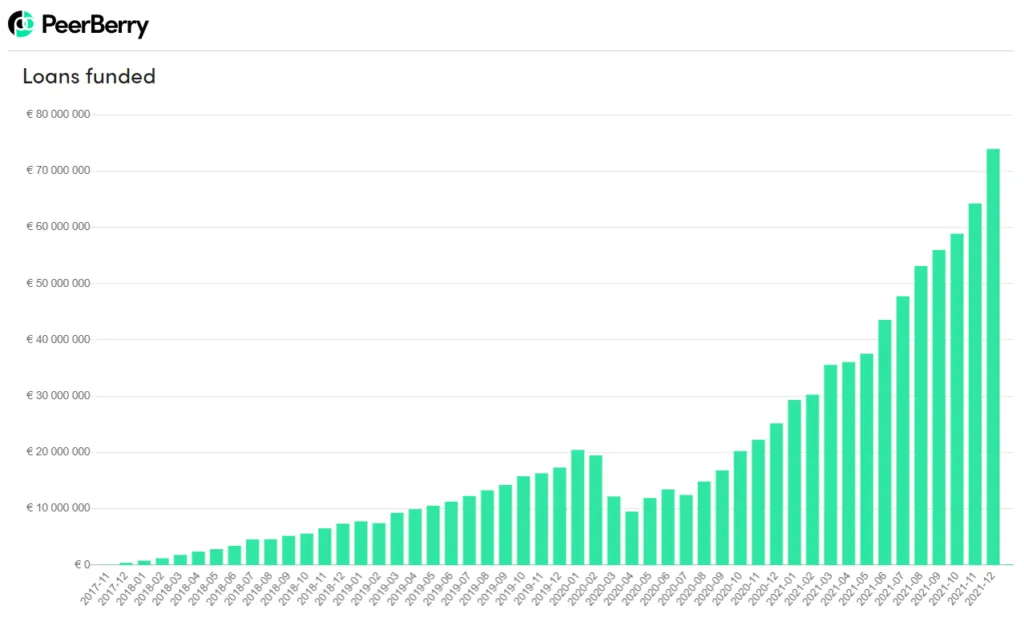

Last year, through the PeerBerry platform EUR 566.20 million of loans were funded, 2.85 times or 185% more than a year earlier.

A record amount of EUR 73.92 million of loans was funded through the PeerBerry platform in December 2021 – three times more than a year ago.

In total, an amount of EUR 957.49 million of loans were funded through the platform since PeerBerry’s inception.

Currently, 75% of PeerBerry’s portfolio makes up short-term loans, 11% real estate loans, 6% leasing, and 6% other long-term loans. 1% of the platform’s portfolio makes up business loans.

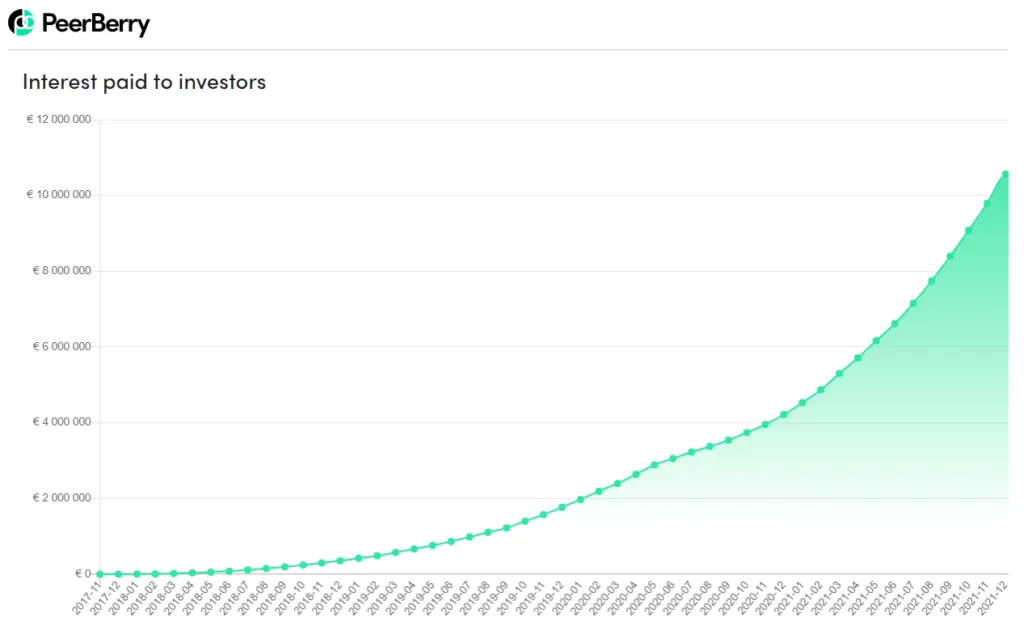

Interest paid to PeerBerry investors

In 2021, PeerBerry investors earned EUR 6.35 million in interest, 2.6 times or 160% more than a year ago.

In December, investors were paid a record amount of interest – EUR 774 049 in total.

Since PeerBerry’s inception, PeerBerry investors have earned a profit of EUR 10.57 million. On the PeerBerry platform, investors have never suffered a loss.

In terms of overall historical performance, PeerBerry is the largest zero-loss marketplace in Europe to invest in loans.

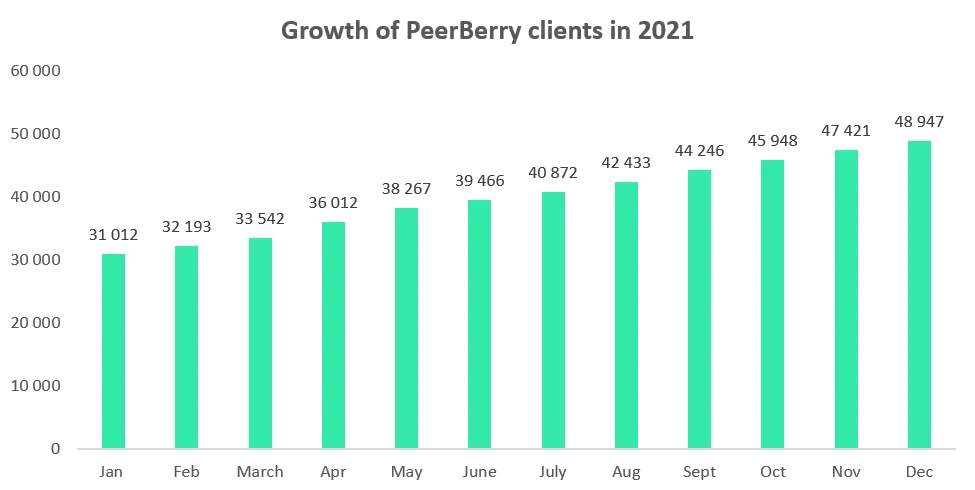

PeerBerry investor portfolio

In 2021, 19 376 new investors (on average, 1615 new investors per month) have joined the PeerBerry investor community, i.e., the PeerBerry investor community grew by 65% last year.

The share of loyal PeerBerry investors grew significantly last year, active investors have significantly increased their portfolios. Currently, the average investment portfolio on PeerBerry amounts to EUR 5340, which shows an increase of 49% over the past year (from EUR 3600 in December 2020 to EUR 5340 in December 2021).

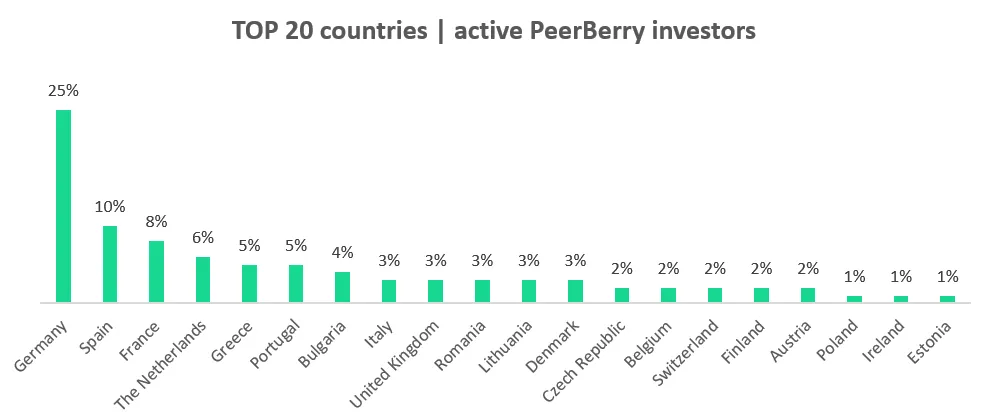

Currently, PeerBerry has more than 49 000 registered users, the majority of investors are from the EU.

“I am grateful to our investors, business partners, and my team for a very exciting and productive year. Without you all, PeerBerry would be just a technology. Together with you, we are a profitable organization that brings benefits to all parties involved. Another exciting year is ahead. In addition to the further development of the platform, our key goals for 2022 remain the same – profitable operations and safe investments for our investors,” – says Arūnas Lekavičius, CEO of PeerBerry.

Key figures for the end of December 2021 (vs November 2021)

- PeerBerry’s total portfolio at the end of December: EUR 85 430 212 (+6% ↑)

- total loans funded (cumulative since inception): EUR 957 305 925 (+8.4% ↑)

- the loan volume funded in December: EUR 73 920 863 (+15% ↑)

- the interest earned by investors since inception: EUR 10 567 414 (+8% ↑)

- the interest paid to investors in December: EUR 774 049 (+9% ↑)

- the average annual ROI at the end of December: 10.97% (-0.04% pp ↓)

- the number of investors at the end of December: 48 947 (+1526 ↑)