03 November 2020

PeerBerry enters its fourth year of operation with record results

In early November, PeerBerry celebrates a three-year birthday. PeerBerry enters its fourth year of operation confidently and demonstrating record results. The platform fully returns to pre-crisis levels.

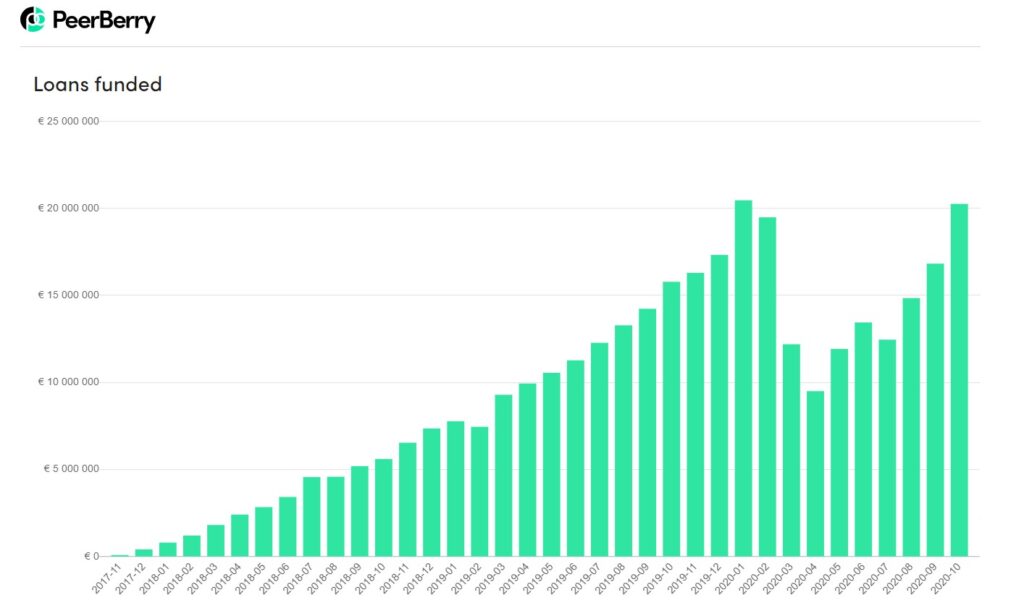

The loans funded on PeerBerry in October exceeded 20.26 million Eur, which is a higher amount compared to loans funded in February this year.

New deposits in October exceeded 3 million Eur, and it is the highest amount of new deposits attracted in one month in the entire history of PeerBerry.

The main PeerBerry figures for the end of October 2020

- the total loan volume originated since inception – 343 284 974 Eur (+6.3% growth)

- the loan volume originated in October – 20 258 473 Eur (+20.5% vs September)

- the number of loans originated in October – 147 407 (+25.7% growth vs September)

- the interest earned by investors since inception – 3 738 097 Eur (+5.6% growth)

- the average annual ROI at the end of October – 12.01% (+1.03 pp vs September)

- the average nominal interest rate of loans originated in October – 11.32 % (+1.15 pp vs September)

- the number of investors at the end of October – 27 432 (+1085 new investors per month)

“The third year of PeerBerry operation was special for us. Despite all the challenges that a pandemic brought to the world, this is a year of great opportunities for us. First of all, the recent developments in the market have highlighted our strengths. The challenges of this year helped us to show and to prove who we are and how good our partners are. Today, our investors see us as one of the most reliable and transparent alternative investment platforms in Europe. For this, I am grateful to my team, business partners, and, of course, investors for their trust in us” – says Arūnas Lekavičius, CEO of PeerBerry.

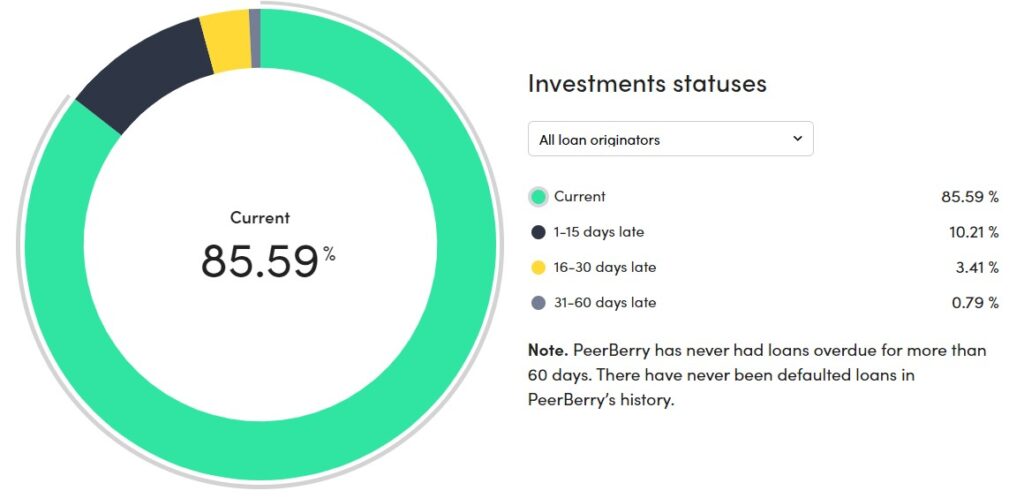

“Investment security is our number one priority, and we will continue providing stability for our investors. Our business partners accumulate a reserve of 10% of the total loan portfolio in cash, which ensures that our partners can settle with investors if this needs to be done more quickly and in a relatively short time, and larger volumes. It is a very important security layer in these challenging times. The share of overdue loans on the PeerBerry platform currently is around 15%. And this is one of the best indicators in the entire P2P market. This shows that even in the most difficult market conditions, our partners can manage risks professionally” – explains A. Lekavičius, CEO of PeerBerry.

Highlights for November 2020

PeerBerry partners are preparing for the upcoming Christmas season and plan to issue about 30% more new loans in the coming months. It is good news for you, our investors, as higher lending volumes will lead to a higher need for our partners to borrow through PeerBerry, and for you, it will bring a higher investment return.

PeerBerry will continue to monitor the market and negotiate with its business partners for more attractive terms for investors. Interest rates were reviewed twice in October. There is a probability that interest rates may increase slightly in November too.

The most recent articles, October 2020

- Buyback Guarantee | P2P Empire talk with the CEO of PeerBerry – Arūnas Lekavčius

- Security layers for PeerBerry investors – why PeerBerry is the right place to invest

- PeerBerry survey | Regulation is the key to the P2P future

- PeerBerry brand is perceived as very reliable and stable. The platform is being rated higher than the P2P market

- 2020 September | All PeerBerry indicators grew. Interest rates have increased