16 July 2021

Investisseur Nomade|Our investor Silvère talks to Arūnas Lekavičius, CEO of PeerBerry

Web entrepreneur and nomadic investor since 2015, Silvère left the asphalt of Paris in France to live on Reunion Island in the Indian Ocean where he started his web activities to find financial freedom. He then moved to Chiang Mai in northern Thailand, a city where many digital nomads work.

On his blog Investisseur Nomade, he documents his crowdlending activities and shares his experiences as an entrepreneur. It is therefore natural that Silvère wanted to ask some questions to Arūnas Lekavičius, CEO of PeerBerry, which is the platform where he is most involved to date. This interview will complete his deep review of PeerBerry.

1. You have spent your entire career in the banking and financial sector. What motivated you to enter the crowdlending sector (which is by definition an alternative to bank loans)?

I have been working in the financial industry since my studies. Within several years I grew up to the top management position, but I have started as the front-office employee in the client service. It gave me a very good basis for understanding daily client’s needs and deep knowledge of the full package of financial products.

Working in banks I was a part of all the processes that take place in banks, so I know how this industry works both internally and externally very well. Over the years of my experience, I have seen how the market is changing and felt the impact of the progressive FinTech sector on the banking sector. It is inevitable time for banks to change, as alternative service providers have brought to the banking sector the need to become less bureaucratic, more tech-advanced, and faster.

By nature, I am a personality of progress, so moving to an alternative to banks to FinTech was a very organic step for me. My experience in banking is a big advantage here while working in PeerBerry. In PeerBerry, I can apply banking standards in the rhythm of FinTech.

2. When you arrived in 2019, what were the priority development areas you had identified? Are your objectives partly or fully achieved today?

When I joined PeerBerry in early 2019, PeerBerry was one of the smallest platforms on the market. PeerBerry’s total portfolio at that time was EUR 8 million, while now, our portfolio is EUR 57 million. We grew about 8 times within few years.

When I joined PeerBerry, my main focus was on strengthening the team, improving the platform as a technology to make it one of the best tools to invest in across the market. I paid a lot of attention to the improvement of internal processes, risk management, efficient work with business partners.

According to the volumes of funded loans, today PeerBerry is the second-largest platform in continental Europe. Our position in the market, and our results say that we have not only achieved our goals but also exceeded them. And we are not going to stop here – our goal is to be a leader in terms of quality in the category of services we provide. The safety of investors’ funds is a top priority for us. To be the largest in the market is not our goal.

3. In 2020, PeerBerry applied to obtain an Investment Brokerage Firm License to the Latvian regulator FCMC. What do you expect from that license?

If this could be my choice or my decision, I would choose one unified EU-level regulation. Unfortunately, such regulation does not yet exist, so individual countries, such as Latvia in our case, are currently regulating the industry separately.

As regulation in Latvia is still in the process, I cannot list exactly and in detail what benefits will be available to investors.

But speaking more globally, regulation in Latvia will bring more confidence to the entire alternative investment industry. As the Baltic States have the highest concentration of platforms, regulation in Lithuania (which is in force for several years already) and Latvia will dictate certain rules of the game for the whole sector. I believe that investors will evaluate platforms even more carefully, will give priority to the regulated platforms, and will have less and less tolerance for shady platforms.

Regulation in Latvia may lead to slight decreases in the interest rates (because the platforms will certainly have higher costs after the regulation). As with banks, the platforms will have more bureaucracy, more regular questionnaires on the client’s ability to assess risks, etc. But basically, nothing significantly should change for investors. The most important aspect of regulation is more transparency and security for investors, including the additional security layer – the rights of investors will be protected under the laws of the Republic of Latvia and EU and the statutory class of investors entitled to compensation of 90% of the invested amount up to EUR 20 000.

4. Recently, you published the distribution of PeerBerry investors by country. The largest number of active investors in PeerBerry’s portfolio are by far from Germany (27%). How do you explain that?

The simplest explanation would be that Germany represents the largest population compared to other EU countries. A second explanation could be that some German investors, who are also active in sharing information about their investment experience, may have started to share such information earlier, in a sufficiently accurate form, and to such an extent that this information reaches a large audience, in this way educating them about alternative investment opportunities. We see that investors from Germany in many other platforms also make up the largest share of investors, so PeerBerry is no exception here.

5. How do you explain that population of France, which is the 2nd in terms of population, ranks only 5th in the distribution of PeerBerry investors by country? Do you plan to translate PeerBerry’s website in more languages in the future to open it to more people?

It may be that the French are more conservative in terms of alternative investments than Germans, so there are fewer of them on the PeerBerry platform, but the number of investors from France is growing noticeably.

We have no plans to introduce new languages yet. As I mentioned above, our goal is not to be the biggest platform. Our goal is to ensure full investment security. Our experience shows that our services are understood by investors from a wide variety of countries and as many languages as we now offer is the very optimal solution.

6. Some crowdlending platforms do not accept French people anymore due to problems with French regulation. Is this something you anticipate for PeerBerry?

Please be informed that currently, we accept French clients although we are constantly monitoring the situation in France and other countries regarding ever-changing regulation.

7. In an interview in august 2019, you said that “PeerBerry does not ask any skin in the game to the loan originators but if we will continue to grow like we are doing now, that may change”. What is your position today?

We believe that together with our partners, we have better security measures for our investors than ‘skin in the game’, that’s why our investors have never had any losses or other problems investing in PeerBerry. Together with our partners, we take/apply several preventive measures:

- PeerBerry partners borrow only up to 45% of their loan portfolio via the platform. PeerBerry controls the level of debt of partners so that it never exceeds the set limit. For example, the total loan portfolio of our main business partners (the companies that work under the Aventus Group name), at the end of June 2021 amounted to EUR 126.5 million, while the debt to PeerBerry is only EUR 41,5 million. Only about 33% of the total portfolio are borrowed funds, the other part of loans is issued by using their own funds. While keeping such a ratio (total portfolio vs borrowed funds) we have no challenges to settle with all investors immediately.

- PeerBerry partners constantly accumulate a 10% (and more) cash reserve of their loan portfolio. PeerBerry can use this reserve at any time to repay loans to investors.

8. PeerBerry has grown a lot these last months and is now a key player of the crowdlending sector in Europe. Don’t you think it is time to apply the international accounting standards IFRS (International financial reporting standards)?

Many investors underestimate the platform and pay not enough attention to the platform’s business partners. It is the wrong approach. Investors through the platform invest in loans issued by lending companies. It is lending companies that return the funds invested to investors and pay interest to investors. Not the platform. The platform is the intermediator between investors and lending companies. Therefore, special attention must be paid to the analysis of the platform’s business partners and their financial statements.

I want to draw your attention, that almost all financial statements of our business partners are audited as it is required by laws and regulations in countries where our partners operate. Our partners in Poland and Ukraine prepare their financial statements under IFRS, as it is required by local regulations. Other lenders comply with regulations in their local countries.

Speaking about the platform, our only income is a commission received from our business partners. Keep in mind that we work in cooperation with the regulator in Latvia for more than one year already. The regulator last year reviewed and evaluated the ownership of the platform, all documents, processes – in fact, everything. This process can be equated with an audit, that’s why we are not doing an additional audit for 2020. If we are double-audited, we will not become twice better. While we are in the process of licensing, we report regularly to the regulator on the activities and results of the platform, i.e. we are already meeting the requirements of the regulator. After PeerBerry is a licensed company, the platform yearly audit will be mandatory.

9. The total number of active investors grew by 30% during the first semester of 2020. This growth has been especially high for those investors who invest from 50 000 € to EUR 100 000 € (+127%). How do you explain that?

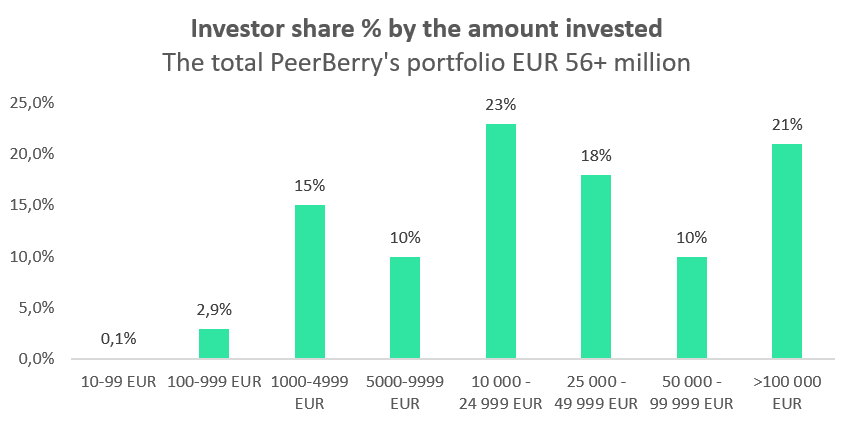

Yes, in the first half of the year we had an increase in new investors in all larger amount categories, and especially in the number of investors in the category of EUR 50,000 to EUR 100,000. However, the largest part of Peerberry’s portfolio (the graph below) consists of investments between EUR 10 000 and EUR 25 000 (23% of the total portfolio) and investments above EUR 100 000 (21% of the total portfolio). Investments from EUR 25 000 to EUR 50 000 make up 18% of the total portfolio.

This year, PeerBerry will celebrate four years of operation. Throughout this period, our investors have not experienced any losses or other problems. Large investments show high investor confidence in the platform.

10. How do you see the near future? What are the areas of development for PeerBerry? Which aspects do you think PeerBerry needs to improve?

One of our top priorities now is regulation and further development of the platform and PeerBerry mobile application.

You can find Arūnas Lekavičius interview in French on Silvère’s blog.